Virtually every investor knows by now that the average actively managed mutual fund fails to beat its benchmark. A variety of studies have come to slightly different results, but about two-thirds of actively managed funds fall short of their index.

See Also: Should You Give These Former Star Fund Managers Another Chance?

That has led to a long-standing question: Can individuals or, for that matter, professional investors identify funds that will beat their benchmarks in the future? (I stress the word future because it�� a piece of cake to spot funds that have beaten their bogeys in the past.)

The American funds, the nation�� largest actively managed fund group, have now entered the fray with a provocative study. It asserts that the American funds have, for the most part, beaten their indexes over the long term. And it argues, convincingly, that they may well continue to do so.

10 Best Industrial Disributor Stocks To Invest In Right Now: Braskem SA (BRKM5)

Braskem SA is a Brazil-based company primarily engaged in the manufacture of basic petrochemical products. The Company operates in five segments: Basic petrochemicals, Polyolefins, Vinyls, International businesses and Chemical Distribution. The Company�� products portfolio includes ethylene, propylene, butadiene, toluene, xylene, benzene, gasoline, diesel oil, liquefied petroleum gas (LPG), as well as thermoplastic resins, such as polyethylene (PE), polypropylene (PP) and polyvinyl chloride (PVC). Additionally, Braskem is also engaged in the import and export of chemicals, petrochemicals and fuels; the production, supply and sale of utilities, such as steam, water, compressed air, industrial gases, as well as the provision of industrial services, and the production, supply and sale of electric energy for its own use and use by other companies. The Company also invests in other companies, either as a partner or shareholder. Advisors' Opinion:- [By Harry Suhartono]

Brazil�� Ibovespa rose for a third day as traders pared bets on higher borrowing costs in Brazil, boosting the outlook for companies that sell in the local market. B2W Cia. Digital led gains among retailers, with Lojas Americanas SA (LAME3) and Natura Cosmeticos SA (NATU3) also trading higher. Petrochemicals producer Braskem SA (BRKM5) was the worst performer on the equity gauge after O Estado de S.Paulo reported Petroleo Brasileiro SA (PETR4) is seeking to raise prices of naphtha sold to the company by 5 percent.

10 Best Industrial Disributor Stocks To Invest In Right Now: Ishares Msci Korea (EWY)

iShares MSCI South Korea Index Fund (the Fund) seeks to provide investment results that correspond generally to the price and yield performance of publicly traded securities in the aggregate in the South Korean market. The Fund's performance is measured by the MSCI Korea Index (the Index).

The Fund invests in a representative sample of securities in the Index, which has a similar investment profile as the Index. iShares MSCI South Korea Index Fund's investment advisor is Barclays Global Fund Advisors.

Advisors' Opinion:- [By Jeff Reeves]

Of course, Samsung�� massive presence has weighed on the region lately. In the last 12 months, the iShares MSCI South Korea Index Fund (EWY) has declined about 4%, pretty much the same performance as Samsung�� stock.

- [By Benjamin Shepherd]

The iShares MSCI Emerging Markets Index (NYSE: EEM) seems to have halted its slide.� The index bottomed out year-to-date on February 3, when it was down 11.2 percent. Since then, it has gained 1.5 percent, but bargains in the emerging markets still abound.

As I discussed in �� Plan, Not a Panic��two weeks ago, emerging markets are in much better economic shape today than they were even just a few years ago, much less during the currency crisis that peaked in 1998. Foreign exchange reserves are generally much more robust, budget deficits are narrower if they exist at all and, so far at least, the full-blown currency war that many were predicting last year isn�� likely to breakout.

With rationality finally setting in, this is a terrific time to do a little bargain hunting in the emerging markets.

The most obvious play here is the iShares MSCI Emerging Markets Index itself. Covering China (18.8 percent of assets), South Korea (16 percent), Taiwan (12 percent) and Brazil (10.2 percent) with smaller positions spanning Asia and Europe, the fund is most exposed to any shift in sentiment.

The fund is currently trading at just 10.2 times forward one-year earnings, well below its average of about 18 times over the past two decades. On a price-to-sales basis it is even more attractive valued at just 1.03 times; the last time the index was this cheap on a sales basis was early 2009.

So while there are always dangers in trying to call a bottom to any market move, valuations alone are attractive enough to start pulling bargain hunters back in.

A broadly diversified play on an emerging market turnaround, iShares MSCI Emerging Markets Index is a great buy up to 45, which leaves plenty of room to run back to the average.

For those who can tolerate a bit more risk, you can also drill down and make more country-specific bets.

At this point my favorite would be iShares MSCI South Korea Index Fund (NYSE: EWY).

Sout

10 Best China Stocks To Watch Right Now: Nobility Homes Inc. (NOBH)

Nobility Homes, Inc., through its subsidiaries, designs, manufactures, and sells a line of manufactured homes in Florida. It offers homes under the trade names of Kingswood, Springwood, Springwood Special, Tropic Isle Special, Regency Manor Special, and Special Edition. The company sells its manufactured homes through a network of its own retail sales centers; and to independent manufactured home retail dealers and manufactured home communities on a wholesale basis. It also provides retail insurance services, which involves placing various types of insurance, including property and casualty, automobile, and extended home warranty coverage, with insurance underwriters on behalf of its customers in connection with their purchase and financing of manufactured homes. As of October 31, 2009, the company operated 15 retail sales centers in north and central Florida. Nobility Homes, Inc. was founded in 1967 and is headquartered in Ocala, Florida.

Advisors' Opinion:- [By Vanina Egea]

Nobility Homes Inc. (NOBH)

Finally, Gabelli reported owning 234.950 shares of Nobility Homes, sized at 5.97% of the company�� shares outstanding and 0.01% of Gabelli�� portfolio. The company has a market cap of $44.63 million, with a P/E of 59.6 and P/S of 2.41.

10 Best Industrial Disributor Stocks To Invest In Right Now: Colony Financial Inc (CLNY)

Colony Financial, Inc. is a real estate investment and finance company. The Company primarily acquires, originates and manages a diversified portfolio of real estate-related debt instruments. The Company focuses on acquiring, originating and managing commercial mortgage loans, which may be performing, sub-performing or non-performing loans (including loan-to-own strategies), and other commercial real estate-related debt investments. The Company is managed by Colony Financial Manager, LLC (the Manager) and an affiliate of the Company.

The Company also may acquire other real estate and real estate-related debt assets. The Company collectively refers to commercial mortgage loans, other commercial real estate-related debt investments, commercial mortgage-backed securities (CMBS), real estate owned (REO), properties and other real estate and real estate-related assets as its target assets.

Advisors' Opinion:- [By Amanda Alix]

Is it risky to be putting so much money into an as-yet unproven business model? Some may think so, including investors. Noting the tumble in stock price that newbies like Silver Bay and American Residential have suffered recently, Colony Capital (NYSE: CLNY ) chief Thomas Barrack postponed�the IPO of his new single-family rental company, Colony American Homes. Similarly, Public Storage (NYSE: PSA ) has filed for an IPO, too, hoping to take its American Homes 4 Rent unit public -- at some unannounced, future date. In the meantime, American Homes can rely on its $500 million credit facility�with Wells Fargo, which may be bumped up to $1 billion if necessary.

- [By Amanda Alix]

For Wall Street types, single-family foreclosures can be bought cheaply and in bulk, then fixed up and rented. Companies like the Blackstone Group (NYSE: BX ) and Colony Financial (NYSE: CLNY ) have been very active in this market, with the former purchasing 16,000 homes just last year, and the latter ramping up its own portfolio to approximately 7,000. This new industry has also spawned fresh entrants from the REIT field, Silver Bay Realty (NYSE: SBY ) and Altisource Residential, (NYSE: RESI ) two trusts that were spun off earlier this year from parent companies Two Harbors Investment (NYSE: TWO ) and Altisource Portfolio Solutions (NASDAQ: ASPS ) , specifically to take advantage of the boom in the foreclosure-to-rental market.

- [By Amanda Alix]

The investment-to-REIT model is alive and well

Before the very end of last year, those involved in the single-family purchase and rental business were largely private equity groups�like the Blackstone Group (NYSE: BX ) , Colony Financial (NYSE: CLNY ) , and Oaktree Capital (NYSE: OAK ) , which bought up distressed properties by the truckload.

10 Best Industrial Disributor Stocks To Invest In Right Now: SGOCO Group Ltd(SGOC)

SGOCO Group, Ltd. designs, manufactures, and distributes liquid crystal display (LCD) consumer products in the People?s Republic of China and internationally. Its products include LCD personal computer monitors, LCD televisions, light emitting diode back-light modules, and application-specific LCD systems. The company also provides custom manufacturing services for application-specific LCD monitors, such as rotating screens, CCTV monitors for security systems, billboard monitors for advertising and public notice systems, and touch screens for non-keyed entries. SGOCO Group, Ltd. sells its products under the SGOCO, Edge 10, POVIZON, and No. 10 brands through a network of independent retail outlets operating under the ?SGOCO Image? name. The company offers its products to industry clients, such as medical centers, educational institutions, government complexes, public emergency response systems, and corporate offices, as well as to retail customers. As of December 31, 201 0, it had 603 retail stores covering 14 provinces and municipalities in the People?s Republic of China. The company, formerly known as SGOCO Technology, Ltd., was founded in 2006 and is based in Beijing, China.

Advisors' Opinion:- [By John Udovich]

On Tuesday, large cap�LCD glass maker�Corning Incorporated (NYSE: GLW) began surging some 20% in after hours trading after announcing that it will take over an existing joint venture (Samsung Corning Precision Materials) with Samsung���meaning it might be worth taking a closer look at some small cap peers like Universal Display Corporation (NASDAQ: OLED), Daktronics, Inc (NASDAQ: DAKT) and SGOCO Group Ltd (NASDAQ: SGOC) who also have a piece of the LCD glass or related flat panel display action. Specifically, the deal involves a series of transactions to�give Corning Incorporated full ownership of Samsung Corning Precision Materials Co., Ltd. (SCP), which manufactures LCD glass in Korea and it should be noted that Corning already relies on sales of LCD-TV glass for the bulk of its profit. In addition, Corning Incorporated���board of directors has authorized an additional $2 billion of share repurchases through Dec. 31, 2015, dependent upon the transaction closing. Wendell P. Weeks, the chairman, CEO and president of Corning Incorporated was quoted in the press release announcing the deal as saying:

10 Best Industrial Disributor Stocks To Invest In Right Now: Xerox Corporation(XRX)

Xerox Corporation provides business process and information technology (IT) outsourcing, and document management services worldwide. Its business process outsourcing services include human resources services; finance and accounting services; healthcare payers and pharma; customer management solutions; healthcare provider solutions; technology-based transactional services for retail, travel, and non-healthcare insurance companies; programs for federal, state, county, and town governments; transportation solutions; and government healthcare solutions. The company is involved in designing, developing, and delivering IT solutions, such as comprehensive systems support, systems administration, database administration, systems monitoring, batch processing, data backup, and capacity planning services; telecommunications management services; and desktop services. Its document outsourcing services comprise managed print services that optimize, rationalize, and manage the operation of Xerox and non-Xerox print devices; and communication and marketing services that deliver design, communication, marketing, logistic, and distribution services through SMS, Web, email, and mobile, as well as print media. The company also manufactures and sells products, including desktop monochrome, color and compact printers, multifunction printers, copiers, digital printing presses, and light production devices for small/mid-size businesses and large enterprises. In addition, it sells paper, wide-format systems, network integration solutions, and electronic presentation systems. The company sells its products and solutions through its sales force, as well as through a network of independent agents, dealers, value-added resellers, systems integrators, and the Web. Xerox Corporation was founded in 1906 and is headquartered in Norwalk, Connecticut.

Advisors' Opinion:- [By Sean Williams]

If you notice a bit more cash in coffers this week, it's because we received our quarterly distribution of $0.0575 per share from Xerox (NYSE: XRX ) on Monday. Xerox is an extremely sneaky play on the implementation of the Patient Protection and Affordable Care Act, because it processes all of California's Medicaid claims. Medicaid is set to expand in a big way across the country, bringing some 16-million new members under its umbrella over the next couple of years. Sure, Xerox still makes money from its legacy printing and service revenue; but it's so much more than that now!

10 Best Industrial Disributor Stocks To Invest In Right Now: Five Prime Therapeutics Inc (FPRX)

Five Prime Therapeutics, Inc., incorporated on December 20, 2001, is a clinical-stage biotechnology company focused on discovering and developing protein therapeutics. Protein therapeutics is antibodies or drugs developed from extracellular proteins or protein fragments that block disease processes, including cancer and inflammatory diseases. The Company�� advanced product candidates include FP-1039/GSK3052230 (FP-1039), FPA008 and FPA144. FP-1039 is a protein therapeutic that traps and neutralizes cancer-promoting fibroblast growth factors (FGFs), involved in cancer cell proliferation and new blood vessel formation. FPA008 is an antibody that inhibits colony stimulating factor-1 receptor (CSF1R), and is being developed to treat patients with inflammatory diseases, including rheumatoid arthritis (RA). FPA144 is an antibody that inhibits FGF receptor 2b (FGFR2b), and is being developed to treat patients with gastric cancer and potentially other solid tumors.

FP-1039

FP-1039 is a protein therapeutic, which includes the extracellular part of FGFR1. FP-1039 acts as an inhibitor of FGFs, because the FGFR1 portion of the molecule binds to FGFs and prevents them from binding to FGFR1 on tumor and blood vessel cells. Because FGF proteins circulating in the blood are called ligands, FP-1039 is called a ligand trap. FP-1039 also includes a portion of an antibody called the Fc region. In preclinical testing, it observed inhibition of tumor growth with single-agent FP-1039, particularly in tumors withFGFR1 gene amplification, including squamous NSCLC and SCLC.

FPA008

FPA008 is an antibody that inhibits CSF1R and is being developed to treat patients with RA. FPA008 also has the potential to treat patients with other inflammatory diseases, including lupus nephritis, psoriatic arthritis, ankylosing spondylitis, fibrosis, inflammatory bowel disease and multiple sclerosis. These are chronic, incurable disorders with serious medical complications and disability for ! which better therapies with novel mechanisms of action are needed. FPA008 is an anti-CSF1R antibody, which it designed to block the ability of IL-34 and CSF1 to bind to and activate CSF1R. FPA008 reduces the numbers and activity of monocytes and macrophages that cause disease, and prevents the production and release of inflammatory factors. The Company and others has demonstrated that both IL-34 and CSF1 are present at increased levels in the inflamed joints of patients with RA.

FPA144

FPA144 is a monoclonal antibody directed against a form of FGFR2, or FGFR2b. When the FGFR2 gene is amplified by cancer cells, the FGFR2b protein is expressed at abnormally high levels on the tumor�� surface. This occurs in some patients with gastric and lower esophageal cancers. The tumor cells that have too much FGFR2b protein on their surface can be identified by special staining tests performed on the tumor. Because FGFR2b is the target for FPA144, patients��tumors can be screened for this protein, helping to identify the patients most likely to respond to FPA144 treatment.

Advisors' Opinion:- [By John Kell and Tess Stynes var popups = dojo.query(".socialByline .popC"); p]

Among the companies with shares expected to actively trade in Monday’s session are Keurig Green Mountain Inc.(GMCR), JA Solar Holdings Co.(JASO) and Five Prime Therapeutics Inc.(FPRX)

10 Best Industrial Disributor Stocks To Invest In Right Now: SilverCrest Mines Inc (SVLC)

SilverCrest Mines Inc. (SilverCrest), incorporated on May 22, 1973, is engaged in the acquisition, exploration and development of mineral properties in Mexico and Central America. The Company�� principal focus is the development and operation of the Santa Elena Project, which property consists of seven mineral concessions totaling 2,726.54 hectares, portions of which include the producing Santa Elena gold and silver mine located northeast of Hermosillo, Sonora State, Mexico. It operates in three segments: the mine operations at Santa Elena, Mexico; mine exploration and evaluation projects at La Joya and Cruz de Mayo, Mexico, and Corporate. The Company is also focused on exploring and developing its La Joya Property located in Durango, Mexico, which contains a discovered polymetallic deposit. The Company�� other mineral properties include the Cruz de Mayo Project (Mexico), the La Joya Property (Mexico), the Silver Angel Project (Mexico) and the El Zapote Project (El Salvador).

The La Joya Property consists of 14 mineral concessions with a total area of approximately 8,379.6 hectares. Its Cruz de Mayo Project consists of two mineral concessions comprising a total of 452 hectares. The Company holds a 100% interest in the Cruz de Mayo 2 concession (which encompasses 434 hectares). The Silver Angel Project consists of two mineral concessions encompassing a total of 3,251 hectares located in the northern Sierra Madre Range in Sonora, Mexico. The Company holds a 100% interest in these concessions, which were acquired by concession applications.

The El Zapote Project consists of two mineral concessions (the El Caliche and San Juan Exploration Concessions) located in the Department of Santa Ana in northern El Salvador, Central America. The Company holds a 100% interest in the El Zapote Project. During the year ended December 31, 2011, an initial drill program of 25 holes totaling approximately 2,900 meters was completed on the Santa Elena Norte target, located approximately 1 kilo! meters north of the Santa Elena Mine.

Advisors' Opinion:- [By Hebba Investments]

Even with rising Q2 costs, GG still has lower true all-in costs than many of its larger competitors' Q1FY13 costs. Compared to Q1FY13 numbers of competitors such as Yamana Gold (AUY) (costs just over $1300), Kinross Gold (KGC) (costs above $1350), Silvercrest Mines (SVLC) (costs below $1100), Newmont Gold (NEM) (costs around $1300) Agnico-Eagle (AEM) (costs around $1400) and Barrick Gold (ABX) (costs around $1200).

10 Best Industrial Disributor Stocks To Invest In Right Now: SodaStream International Ltd.(SODA)

SodaStream International Ltd. engages in the development, manufacture, and marketing of home beverage carbonation systems and related products. Its home beverage carbonation systems enable consumers to transform ordinary tap water into carbonated soft drinks and sparkling water. The company offers a range of soda makers; exchangeable carbon-dioxide (CO2) cylinders; beverage-grade CO2 refills; reusable carbonation bottles; and various flavors comprising fruit, carbonated soft drink, and enhanced flavors to add to the carbonated water. It also sells additional accessories for its products, including bottle cleaning materials and ice cube trays manufactured by third parties. The company sells its products under the SodaStream and Soda-Club brand names through approximately 50,000 retail stores in 42 countries, as well as through the Internet; and distributes its products directly in 12 countries and indirectly through local distributors in other markets. It operates in Europe , North and Central America, Israel, South Africa, Australia, New Zealand, and east Asia. The company was formerly known as Soda-Club Holdings Ltd. and changed its name to SodaStream International Ltd. in March 2010. SodaStream International Ltd. is headquartered in Airport City, Israel.

Advisors' Opinion:- [By Michael Lewis]

Last year, Starbucks (NASDAQ: SBUX ) sent a warning shot across Green Mountain Coffee Roasters'� (NASDAQ: GMCR ) nose with the introduction of the Verismo brewing system. As the latter's K-Cup patent expired and generics flooded the market, investors ran for the hills with the idea of do-no-wrong Howard Schulz moving his company in direct competition. Now, another home-brew innovator may be shaking in its boots as Starbucks has begun offering a new product in select stores. Should SodaStream (NASDAQ: SODA ) investors fear the Seattle juggernaut?

10 Best Industrial Disributor Stocks To Invest In Right Now: Yahoo! Inc.(YHOO)

Yahoo! Inc., together with its subsidiaries, operates as a digital media company that delivers personalized digital content and experiences through various devices worldwide. It offers online properties and services to users; and a range of marketing services to businesses. The company?s communications and communities offerings include Yahoo! Mail, Yahoo! Messenger, Yahoo! Groups, Yahoo! Answers, Flickr, and Connected TV, which provide a range of communication and social services to users and small businesses enabling users to organize into groups and share knowledge, common interests, and photos. Its search products comprise Yahoo! Search and Yahoo! Local, available free to users to navigate the Internet and discover content. The company?s marketplaces offerings and services include Yahoo! Shopping, Yahoo! Travel, Yahoo! Real Estate, Yahoo! Autos, and Yahoo! Small Business, which allow users to research specific topics, products, services, or areas of interest by review ing and exchanging information, obtaining contact details, or considering offers from providers of goods, services, or parties with similar interests. Its media offerings comprise Yahoo! Homepage, Yahoo! News, Yahoo! Sports, Yahoo! Finance, My Yahoo!, Yahoo! Toolbar, Yahoo! Entertainment & Lifestyles, Yahoo! Contributor Network, and Yahoo! Pulse, which are designed to engage users with online content and services on the Web. The company also offers marketing services, such as display and search advertising, listing-based services, and commerce-based transactions to advertisers. In addition, it provides software and platform offerings for third-party developers, advertisers, and publishers, such as Yahoo! Developer Network, Yahoo! Open Strategy, Yahoo! Application Platform, Yahoo! Updates, Yahoo! Query Language, and Yahoo! Search BOSS. The company has strategic alliances with Nokia and ABC News, Inc. Yahoo! Inc. was founded in 1994 and is headquartered in Sunnyvale, Californi a.

Advisors' Opinion:- [By Eric Volkman]

Yahoo! (NASDAQ: YHOO ) has added some tech industry heft to its advertising efforts. The company announced it hired Ned Brody as its senior vice president and head of the Americas, putting him in charge of its advertising business on the two key continents. The appointment is effective immediately.

- [By Charles Carlson]

Steve Halpern: Now, let's turn to your more speculative pick from 2013, which was Yahoo (YHOO), and the stock's risen over 100%, since you recommended it. What made you choose that as a speculative favorite for the past year.

- [By Rick Aristotle Munarriz]

Alamy Microsoft CEO Steve Ballmer is heading for the exit. Should Microsoft (MSFT) shareholders follow suit? Shares of the software giant soared 7 percent on Friday on news that it would be replacing Ballmer as CEO within the next 12 months. The market's opinion of the news must sting Ballmer (though it also made him a few hundred million dollars richer), but investors expecting that Microsoft's next leader will be able to return the company to its former glory may be in for a rude awakening. Why would consumers and businesses want to return to a time when they were dependent on a stodgy operating system that was expensive and slow to adapt? What if Microsoft doesn't find the right CEO? What if there is no such thing as the CEO? Those are just a few of the heavy questions that Microsoft's stockholders face in light of Ballmer's pending departure, and they may not like the answers. You Can't Go Home Again First, let's talk fundamentals. Does Microsoft's business make it a good buy for forward-thinking investors? Well, in the past dozen years, Microsoft has gone from being the world's most valuable company to one that is worth less than two-thirds of what current leader Apple (AAPL) is today. Microsoft and Google (GOOG) commanded nearly identical $290 billion market caps at the kick off of this trading week, and the search engine giant wasn't even publicly traded when Ballmer was tapped to be Microsoft's CEO in 2000. In fact, Google had only been founded 16 months earlier. Tech babies grow so fast these days. And that, at least in part, is the root of Microsoft's problems. Computing hasn't merely evolved -- it has metamorphosed. Consumers aren't buying PCs like they used to. Desktop and laptop sales have fallen sharply for five consecutive quarters, which has never happened before. That's not a lull. That's not a bad stretch. That's a trend. And it isn't just a Windows woe. Apple's Mac sales have also been sliding in recent quarters. Most PC buyers never

- [By Wall Street Sector Selector]

So does "Big Ben" trump everything? Apparently so, as the S&P 500 repeatedly sets new record highs. What has kept stocks flying? NOT QUARTERLY Earnings as the list below clearly demonstrates:

United Parcel Service (UPS) – On July 12, the company announced that it was lowering its profit forecast for the year and that it expects to report earnings of $1.13 per share on July 23. Although analysts were expecting annual EPS to reach $4.98, the company lowered its guidance to a range between $4.65 and $4.85.Yahoo (YHOO) – Although Yahoo's earnings of 35 cents per share beat estimates of 30 cents per share, the company fell short at the top line, reporting quarterly revenue of $1.07 billion, compared with estimates of $1.8 billion.Google – Google reported quarterly earnings of $9.56 per share on net revenue of $11.1 billion, falling short of estimates of $10.80 per share on net revenue of $11.4 billion.Intel (INTC) – Intel reported quarterly EPS of 39 cents on revenue of $12.8 billion, missing estimates of 40 cents per share on revenue of $12.9 billion.Coca-Cola (KO) – Coke reported quarterly EPS of 59 cents on revenue of $12.75 billion, compared with estimates of 63 cents per share on $12.96 billion in revenue.American Micro Devices – AMD reported a "less bad than expected" quarterly loss of 9 cents per share on revenue of $1.16 billion, beating estimates of a 12-cent-per-share loss on revenue of $1.11 billionMicrosoft – Microsoft reported quarterly EPS of 59 cents on revenue of $19.9 billion, missing estimates of 75 cents per share on revenue of $20.73 billion.IBM: Big Blue reported quarterly EPS of $3.91 on revenue of $24.9 billion. Although it beat the EPS estimate of $3.77, it missed the revenue estimate of $25.37 billion.FedEx (FDX) – FedEx beat quarterly EPS estimates of $1.96, reporting earnings of $2.13 per share. However, its quarterly revenue of $11.45 billion fell short of the estima

Related BZSUM Mid-Day Market Update: Nordion Surges On Acquisition News; BlackBerry Shares Decline Brent Supported By Conflict Between Russia And The West

Related BZSUM Mid-Day Market Update: Nordion Surges On Acquisition News; BlackBerry Shares Decline Brent Supported By Conflict Between Russia And The West  Bloomberg

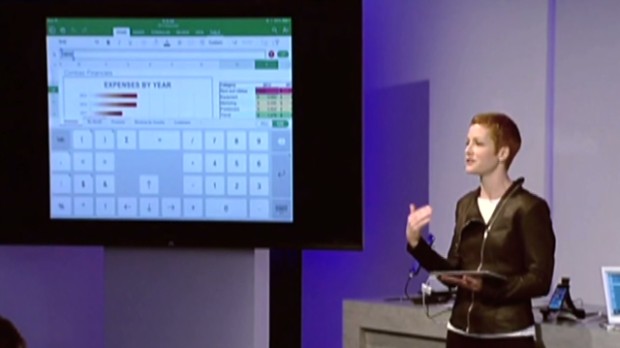

Bloomberg  See Microsoft's new Office for iPad NEW YORK (CNNMoney) After years of speculation, Microsoft Office is finally on the iPad.

See Microsoft's new Office for iPad NEW YORK (CNNMoney) After years of speculation, Microsoft Office is finally on the iPad.

Popular Posts: 5 Blue-Chip Stocks Set to Boom Even MoreThe Best Ways to Buy the Alibaba IPOAmerican Funds: 5 Mutual Funds to Buy Recent Posts: 3 Homebuilders Building on Solid Foundations 3 Stock Spinoffs That Will Outperform Their Parents Take Buffett’s Advice: 5 Vanguard Funds to Buy View All Posts

Popular Posts: 5 Blue-Chip Stocks Set to Boom Even MoreThe Best Ways to Buy the Alibaba IPOAmerican Funds: 5 Mutual Funds to Buy Recent Posts: 3 Homebuilders Building on Solid Foundations 3 Stock Spinoffs That Will Outperform Their Parents Take Buffett’s Advice: 5 Vanguard Funds to Buy View All Posts  It seems there's more to that caution than just a chilly winter. Homebuilders are having trouble finding buildable lots and skilled workers. Many have tempered their sales expectations for the next six months.

It seems there's more to that caution than just a chilly winter. Homebuilders are having trouble finding buildable lots and skilled workers. Many have tempered their sales expectations for the next six months. KB Home (KBH) delivered its first Q1 profit since 2007 last week on the back of strong price increases across all four of its regions. Chief among the increases was its West Coast region which saw the average sale price increase 30% year-over-year to $525,000. The bad news is that only 346 homes were delivered on the West Coast in Q1 compared to 509 a year earlier.

KB Home (KBH) delivered its first Q1 profit since 2007 last week on the back of strong price increases across all four of its regions. Chief among the increases was its West Coast region which saw the average sale price increase 30% year-over-year to $525,000. The bad news is that only 346 homes were delivered on the West Coast in Q1 compared to 509 a year earlier. You usually can't go wrong betting on the biggest operators in any industry. New home development is no different. If its Q1 results are any indication, Miami-based Lennar (LEN) is a good bet when it comes to housing.

You usually can't go wrong betting on the biggest operators in any industry. New home development is no different. If its Q1 results are any indication, Miami-based Lennar (LEN) is a good bet when it comes to housing. KeyBanc analyst Kenneth Zener downgraded LEN stock from buy to hold in early March. At the same time, the analyst upgraded PulteGroup (PHM) from hold to buy citing its measured growth combined with an attractive valuation as reasons for buying PHM stock.

KeyBanc analyst Kenneth Zener downgraded LEN stock from buy to hold in early March. At the same time, the analyst upgraded PulteGroup (PHM) from hold to buy citing its measured growth combined with an attractive valuation as reasons for buying PHM stock.