This week should see the debut of three new publicly traded partnerships.

Westlake Chemical Partners (expected ticker WLKP) was recently formed by Westlake Chemical (NYSE: WLK) to operate, acquire and develop ethylene production facilities and related assets. WLK is a manufacturer and supplier of petrochemicals, vinyls, polymers and building products produced at 16 plants across North America and one in China.

Westlake Chemical Partners' business and operations will be conducted through OpCo, a new Westlake affiliate in which WLKP will initially own a 10% limited partner stake as well as the general partner interest. WLK retained a 90% limited partner (LP) interest in OpCo and will own WLKP's general partner and 55.7% of WLKP's limited partner units, along with the incentive distribution rights.

OpCo's assets will be comprised of three production facilities that convert ethane into ethylene, which is the world's most widely used petrochemical in terms by volume. Aggregate annual capacity of the facilities is approximately 3.4 billion pounds. Assets also include the Longview Pipeline, a 200-mile ethylene pipeline with a capacity of 3.5 million pounds per day that runs from Mont Belvieu, Texas to the Longview, Texas chemical complex.

The new MLP will derive substantially all of its revenue from its ethylene production facilities. Westlake's downstream polyethylene (PE) and polyvinyl chloride (PVC) production facilities will consume a substantial majority of the ethylene produced by OpCo. In connection with the IPO, OpCo will enter into a 12-year ethylene sales agreement with Westlake, under which Westlake will agree to purchase 95% of OpCo's planned ethylene production each year on a cost-plus basis that is projected to generate a fixed margin of $0.10 per pound.

The offering is expected to price on July 29 in a range of $19.00 to $21.00, generating estimated proceeds of $225 ! million. WLKP's partnership agreement provides for a minimum quarterly distribution of $0.2750 per unit for each whole quarter, or $1.10 per unit on an annualized basis. At the midpoint of the offering price, this projects to an annual yield of 5.5%.

Transocean Partners (expected ticker RIGP) is a Marshall Islands growth-oriented limited liability company recently formed by Transocean (NYSE: RIG), to own and operate a fleet of offshore drilling rigs.

Transocean owns or has partial ownership interests in 77 mobile offshore drilling units, and specializes in operations in technically demanding regions of the global offshore drilling industry, with a particular focus on ultra-deepwater and harsh environment drilling services.

Initially, Transocean Partners is to own 51% of three ultra-deepwater drilling rigs currently operating in the US Gulf of Mexico. Transocean will own the remaining 49% of each. The rigs currently operate under long-term contracts with Chevron (NYSE: CVX) and BP (NYSE: BP) with an average remaining contract term of approximately four years.

The partnership plans to grow quarterly distributions by making strategic acquisitions from Transocean or third parties. The partnership agreement calls for Transocean to grant a right of first offer to Transocean Partners for its remaining ownership interests in each of the three rigs should Transocean decide to sell such interests. Transocean is also required to offer the partnership the opportunity to purchase a least a 51% interest in four additional drillships within five years following the closing of the IPO.

The IPO will market 17.5 million shares in a projected range of $19 to $21, and was expected to price on July 30. The partnership agreement calls for an initial quarterly distribution of $0.3625 per unit for each whole quarter, or $1.45 per unit on an annualized basis, for a projected yield at the IPO midpoint of 7.25%. Notably, like many other partnerships with significant foreign or marine operati! ons, the ! partnership has chosen to pay taxes as a corporation, which means distributions will be 1099 income. (To better understand why a partnership would elect to be taxed as a corporation, see Marshalling the Marines.)

VTTI Energy Partners (expected ticker VTTI) is a Marshall Islands limited partnership formed by VTTI, one of the world's largest independent energy terminaling businesses, to provide long-term, fee-based terminaling services for customers engaged in the production, processing, distribution, and marketing of refined petroleum products and crude oil. VTTI was formed in 2006 by Vitol — one of the world's largest independent energy traders — and MISC, one of the leading maritime shippers of refined petroleum products and crude oil.

Initial assets of the partnership consist of a 36% interest in VTTI Operating, a VTTI subsidiary which owns a portfolio of six terminals with 396 tanks and 35.5 million barrels of refined petroleum product and crude oil storage capacity located in Europe, the Middle East, Asia, and North America.

The parent VTTI has increased its operating storage capacity by 47.6 million barrels through organic development projects, greenfield construction and acquisitions. VTTI Energy Partners plans to continue to grow through acquisitions from VTTI or third parties, organic development opportunities, greenfield construction and optimization of existing assets.

The offering is exactly the same size as the Transocean Partners IPO — 17.5 million shares at a projected offering range of $19-$21 — and was expected to price on July 31. The partnership agreement calls for an initial quarterly distribution of $0.2625 per unit for each complete quarter, or $1.05 per unit on an annualized basis, for a projected yield at the IPO midpoint of 5.25%. Also, as in the case of Transocean Partners, VTTI Energy Partners has chosen to be taxed as a corporation and will pay 1099 income.

(Follow Robert Rapier on Twitter, LinkedIn, or Facebook.! )

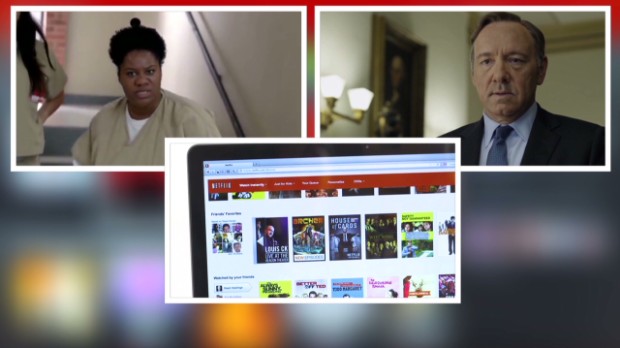

Remember this from early June? Netflix and Verizon are still feuding over who's to blame for slow streaming speeds. NEW YORK (CNNMoney) The battle over Netflix streaming speeds is still raging.

Remember this from early June? Netflix and Verizon are still feuding over who's to blame for slow streaming speeds. NEW YORK (CNNMoney) The battle over Netflix streaming speeds is still raging.  Online video is the buzz of Sun Valley

Online video is the buzz of Sun Valley  Guillermo Legaria, AFP/Getty ImagesAn employee of the Juan Valdez Origin boutique store in Bogata, Colombia, serves a cup of coffee during the National Coffee Day last month. BOGOTA, Colombia -- Make room Juan Valdez, it's time to meet the green-aproned barista. On Wednesday, Starbucks (SBUX) is making its much-anticipated debut in the country synonymous with coffee after years of roasting Colombia's Arabica beans for billions of java lovers the world over. The three-floor coffee house in Bogota is the first of 50 that the Seattle-based company plans to open here in the next five years. In a nod to the country's proud coffee-growing tradition, it's also the only one in the world to serve exclusively locally sourced coffee. But will Colombians answer Starbucks' siren call and ditch a popular local chain bearing the bushy-whiskered coffee farmer's name? Colombia's coffee federation, owner of the Juan Valdez chain, is outwardly welcoming the competition. The arrival of Starbucks it says will boost the market for gourmet java even if sales at its nearly 200 stores in Colombia take a hit over the short term "There's room in the market for us both," said Alejandra Londono, head of international sales for the Colombian chain. Juan Valdez's social mission promoting Colombian coffee and contributing to producers' welfare is likely to keep customers loyal, said Londono. Since its founding 11 years ago, the Colombian chain has funneled more than $20 million to a national fund that supports the country's 560,000 coffee-growing families, some of whom also own shares in the company. While Starbucks also has burnished its image for corporate responsibility, offering employees in the U.S. generous health care benefits and now online college courses, it's stayed clear of Colombia, Latin America's third largest economy, even as it has opened more than 700 stories in 12 other countries in the region. That may have been because it feared trampling on local sensibilities already hurt by the branding of coffee that leaves growers earning just a few pennies from every $4 venti latte sold. Indeed, a desire to overcome the commodities curse is what's been driving the federation's focus on adding value up the retail chain, a strategy reflected in more sophisticated local coffee-drinking culture. While known for exporting the world's finest beans, until recently Colombians' taste in coffee was quite provincial, relegated to a preference for heavily sweetened, warmed-over black coffee known as tinto, which is sold nearly everywhere. Across from where Starbucks is opening on a leafy park in north Bogota, office workers at a rival Juan Valdez seemed thrilled with the prospect of having a new option for their late-afternoon caffeine fix. Service at their local coffee house, they said, has been improving ever since Starbucks announced it was coming a year ago. "I like Juan Valdez but it doesn't mean I'll never go to Starbucks just because I want to support our own," said Marcela Gomez, an architect. "A little healthy competition is good."

Guillermo Legaria, AFP/Getty ImagesAn employee of the Juan Valdez Origin boutique store in Bogata, Colombia, serves a cup of coffee during the National Coffee Day last month. BOGOTA, Colombia -- Make room Juan Valdez, it's time to meet the green-aproned barista. On Wednesday, Starbucks (SBUX) is making its much-anticipated debut in the country synonymous with coffee after years of roasting Colombia's Arabica beans for billions of java lovers the world over. The three-floor coffee house in Bogota is the first of 50 that the Seattle-based company plans to open here in the next five years. In a nod to the country's proud coffee-growing tradition, it's also the only one in the world to serve exclusively locally sourced coffee. But will Colombians answer Starbucks' siren call and ditch a popular local chain bearing the bushy-whiskered coffee farmer's name? Colombia's coffee federation, owner of the Juan Valdez chain, is outwardly welcoming the competition. The arrival of Starbucks it says will boost the market for gourmet java even if sales at its nearly 200 stores in Colombia take a hit over the short term "There's room in the market for us both," said Alejandra Londono, head of international sales for the Colombian chain. Juan Valdez's social mission promoting Colombian coffee and contributing to producers' welfare is likely to keep customers loyal, said Londono. Since its founding 11 years ago, the Colombian chain has funneled more than $20 million to a national fund that supports the country's 560,000 coffee-growing families, some of whom also own shares in the company. While Starbucks also has burnished its image for corporate responsibility, offering employees in the U.S. generous health care benefits and now online college courses, it's stayed clear of Colombia, Latin America's third largest economy, even as it has opened more than 700 stories in 12 other countries in the region. That may have been because it feared trampling on local sensibilities already hurt by the branding of coffee that leaves growers earning just a few pennies from every $4 venti latte sold. Indeed, a desire to overcome the commodities curse is what's been driving the federation's focus on adding value up the retail chain, a strategy reflected in more sophisticated local coffee-drinking culture. While known for exporting the world's finest beans, until recently Colombians' taste in coffee was quite provincial, relegated to a preference for heavily sweetened, warmed-over black coffee known as tinto, which is sold nearly everywhere. Across from where Starbucks is opening on a leafy park in north Bogota, office workers at a rival Juan Valdez seemed thrilled with the prospect of having a new option for their late-afternoon caffeine fix. Service at their local coffee house, they said, has been improving ever since Starbucks announced it was coming a year ago. "I like Juan Valdez but it doesn't mean I'll never go to Starbucks just because I want to support our own," said Marcela Gomez, an architect. "A little healthy competition is good." Susan Walsh/APFederal Reserve Chair Janet Yellen WASHINGTON -- The U.S. economic recovery remains incomplete, with a still-ailing job market and stagnant wages justifying loose monetary policy for the foreseeable future, Federal Reserve Chair Janet Yellen told a Senate committee Tuesday. In a strong defense of the central bank's current stance, Yellen said early signs of a pickup in inflation aren't enough for the Fed to accelerate its plans for raising interest rates, a move currently expected in the middle of next year. That could change, with interest rates rising sooner and faster, if data show labor markets improving more quickly than expected, she said. But as it stands, "although the economy continues to improve, the recovery is not yet complete," Yellen said in semi-annual testimony before the Senate Banking Committee, repeating her focus on lagging labor force participation and weak wage growth as key to any conclusions about the economy's health. "Too many Americans remain unemployed," Yellen said. U.S. stock markets dropped slightly after the release of Yellen's testimony and an accompanying monetary policy report, with shares of biotechnology and social media stocks being particularly hard hit after being singled out in the report for their "stretched" valuations. "These are the sub-industries that have caused a lot of longtime stock watchers to scratch their heads. These companies have relative few earnings, especially in the biotech area," said Kim Forrest, senior equity research analyst with Fort Pitt Capital Group in Pittsburgh. "I hope she [Yellen] is not surprised by what the market is doing. I'd say she'd like to deflate these bubbles with a little bit of stock talk." In general, however, the report said current asset and security prices remain in line with "historic norms." Fed Relatively Upbeat Yellen presented a broad overview of an economy still in transition from the 2007-2009 economic crisis. In the accompanying report, the Fed said its balance sheet would top out at $4.5 trillion when its bond-buying program ends in October, a sign of how much stimulus the central bank has had to unleash to support the economy. With another $2.6 trillion held in reserve by banks, the report said it "will not be feasible" for the Fed to rely on the traditional Fed Funds market to manage interest rates -- a judgment implicit in its recent work on new interest rate tools. Yellen said the economy continues to generate jobs and steady growth, but she added that Fed policymakers currently expect their preferred measure of inflation to stand at between 1.5 percent and 1.75 percent for 2014, short of the central bank's 2 percent target. The housing market remains weak, Yellen said, and business investment less than hoped. Fed chiefs are mandated by law to report to Congress twice a year on monetary policy, and the hearing Tuesday was Yellen's second such appearance. Her first turned into a marathon grilling about her philosophy and views of the economy. The Fed faces a complex agenda as it weans the U.S. economy from the massive stimulus programs put in place to fight the financial crisis. Economic data has kept Fed policymakers relatively upbeat that the economy will make steady progress towards the central bank's goals. But there is also the potential for serious division. Some policymakers worry the Fed is falling behind the curve on rate hikes and that Yellen is taking too much of an impromptu approach to the interest rate decision. In her prepared testimony, she held firm to her view that low labor force participation and other labor market statistics are evidence of slack that needs to be absorbed by stronger job growth, not just a sign of unavoidable demographic change. For now, a more dovish approach holds sway at the central bank, with several officials saying they'd tolerate inflation higher than the 2 percent target for a period of time in order to ensure growth is on track, wages are rising, and as many workers as possible have been drawn back into jobs. Responding to questions from committee members, she said it would be a "mistake" for the Fed to adopt a strict rule for raising interest rates, something advocated by some lawmakers and Fed officials. -.

Susan Walsh/APFederal Reserve Chair Janet Yellen WASHINGTON -- The U.S. economic recovery remains incomplete, with a still-ailing job market and stagnant wages justifying loose monetary policy for the foreseeable future, Federal Reserve Chair Janet Yellen told a Senate committee Tuesday. In a strong defense of the central bank's current stance, Yellen said early signs of a pickup in inflation aren't enough for the Fed to accelerate its plans for raising interest rates, a move currently expected in the middle of next year. That could change, with interest rates rising sooner and faster, if data show labor markets improving more quickly than expected, she said. But as it stands, "although the economy continues to improve, the recovery is not yet complete," Yellen said in semi-annual testimony before the Senate Banking Committee, repeating her focus on lagging labor force participation and weak wage growth as key to any conclusions about the economy's health. "Too many Americans remain unemployed," Yellen said. U.S. stock markets dropped slightly after the release of Yellen's testimony and an accompanying monetary policy report, with shares of biotechnology and social media stocks being particularly hard hit after being singled out in the report for their "stretched" valuations. "These are the sub-industries that have caused a lot of longtime stock watchers to scratch their heads. These companies have relative few earnings, especially in the biotech area," said Kim Forrest, senior equity research analyst with Fort Pitt Capital Group in Pittsburgh. "I hope she [Yellen] is not surprised by what the market is doing. I'd say she'd like to deflate these bubbles with a little bit of stock talk." In general, however, the report said current asset and security prices remain in line with "historic norms." Fed Relatively Upbeat Yellen presented a broad overview of an economy still in transition from the 2007-2009 economic crisis. In the accompanying report, the Fed said its balance sheet would top out at $4.5 trillion when its bond-buying program ends in October, a sign of how much stimulus the central bank has had to unleash to support the economy. With another $2.6 trillion held in reserve by banks, the report said it "will not be feasible" for the Fed to rely on the traditional Fed Funds market to manage interest rates -- a judgment implicit in its recent work on new interest rate tools. Yellen said the economy continues to generate jobs and steady growth, but she added that Fed policymakers currently expect their preferred measure of inflation to stand at between 1.5 percent and 1.75 percent for 2014, short of the central bank's 2 percent target. The housing market remains weak, Yellen said, and business investment less than hoped. Fed chiefs are mandated by law to report to Congress twice a year on monetary policy, and the hearing Tuesday was Yellen's second such appearance. Her first turned into a marathon grilling about her philosophy and views of the economy. The Fed faces a complex agenda as it weans the U.S. economy from the massive stimulus programs put in place to fight the financial crisis. Economic data has kept Fed policymakers relatively upbeat that the economy will make steady progress towards the central bank's goals. But there is also the potential for serious division. Some policymakers worry the Fed is falling behind the curve on rate hikes and that Yellen is taking too much of an impromptu approach to the interest rate decision. In her prepared testimony, she held firm to her view that low labor force participation and other labor market statistics are evidence of slack that needs to be absorbed by stronger job growth, not just a sign of unavoidable demographic change. For now, a more dovish approach holds sway at the central bank, with several officials saying they'd tolerate inflation higher than the 2 percent target for a period of time in order to ensure growth is on track, wages are rising, and as many workers as possible have been drawn back into jobs. Responding to questions from committee members, she said it would be a "mistake" for the Fed to adopt a strict rule for raising interest rates, something advocated by some lawmakers and Fed officials. -.

) reported its second quarter results, posting gains in sales and earnings compared to last year’s Q2.

) reported its second quarter results, posting gains in sales and earnings compared to last year’s Q2.

Popular Posts: Hottest Technology Stocks Now – IGTE GTAT PRLB BBRY8 Biotechnology Stocks to Buy NowHottest Healthcare Stocks Now – MNKD INO ACAD INCY Recent Posts: Hottest Technology Stocks Now – INVN SMI SPIL BBRY Biggest Movers in Services Stocks Now – TLK EJ RAD XRS Biggest Movers in Basic Materials Stocks Now – SCCO SID CENX GGB View All Posts 3 Road and Rail Stocks to Sell Now

Popular Posts: Hottest Technology Stocks Now – IGTE GTAT PRLB BBRY8 Biotechnology Stocks to Buy NowHottest Healthcare Stocks Now – MNKD INO ACAD INCY Recent Posts: Hottest Technology Stocks Now – INVN SMI SPIL BBRY Biggest Movers in Services Stocks Now – TLK EJ RAD XRS Biggest Movers in Basic Materials Stocks Now – SCCO SID CENX GGB View All Posts 3 Road and Rail Stocks to Sell Now

MORE GURUFOCUS LINKS

MORE GURUFOCUS LINKS  35.66 (1y: +8%) $(function(){var seriesOptions=[],yAxisOptions=[],name='ALTR',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1373259600000,33.03],[1373346000000,33.58],[1373432400000,33.84],[1373518800000,34.5],[1373605200000,35.05],[1373864400000,34.81],[1373950800000,34.9],[1374037200000,35.08],[1374123600000,35.66],[1374210000000,35.51],[1374469200000,35.56],[1374555600000,35.47],[1374642000000,35.11],[1374728400000,35.2],[1374814800000,34.99],[1375074000000,34.9],[1375160400000,35.19],[1375246800000,35.56],[1375333200000,36.47],[1375419600000,36.41],[1375678800000,36.18],[1375765200000,36.22],[1375851600000,36.15],[1375938000000,36.26],[1376024400000,36.01],[1376283600000,36.12],[1376370000000,36.3],[1376456400000,35.56],[1376542800000,34.69],[1376629200000,35],[1376888400000,34.78],[1376974800000,34.71],[1377061200000,34.67],[1377147600000,34.58],[1377234000000,34.66],[1377493200000,35.15],[1377579600000,34.53],[1377666000000,34.79],[1377752400000,35.69],[1377838800000,35.17],[1378184400000,35.88],[1378270800000,37.225],[1378357200000,37.46],[1378443600000,37.57],[1378702800000,37.98],[1378789200000,38.645],[1378875600000,38.7],[1378962000000,38.8],[1379048400000,38.67],[1379307600000,37.85],[1379394000000,38.18],[1379480400000,38.14],[1379566800000,37.981],[1379653200000,37.6],[1379912400000,37.305],[1379998800000,37.36],[1380085200000,37.37],[1380171600000,37.3],[1380258000000,36.96],[1380517200000,37.16],[1380603600000,37],[1380690000000,36.84],[1380776400000,36.66],[1380862800000,36.87],[1381122000000,36.52],[1381208400000,36.09],[1381294800000,35.79],[1381381200000,36.725],[1381467600000,37.19],[1381726800000,37.31],[1381813200000,36.7],[1381899600000,37.03],[1381986000000,37.825],[1382072400000,37.48],[1382331600000,37.46],[1382418000000,37.32],[1382504400000,32.3],[1382590800000,33.175],[1382677200000,33.13],[1382936400000,33.45],[1383022800000,33.86],[1383109200000,33.475],[1383195600000,33.605],[1383282000000,33.17],[1383544800000,33.3],[1383631200000,32.97],[1383717600000,33.11],[138! 3804000000,33.13],[1383890400000,33.39],[1384149600000,32.929],[1384236000000,33.16],[1384322400000,33.18],[1384408800000,32.48],[1384495200000,32.72],[1384754400000,32.47],[1384840800000,31.06],[1384927200000,31.35],[1385013600000,32.01],[1385100000000,32.34],[1385359200000,32.24],[1385445600000,32.09],[1385532000000,32.52],[1385704800000,32.25],[1385964000000,32.05],[1386050400000,31.88],[1386136800000,31.97],[1386223200000,31.86],[1386309600000,32.12],[1386568800000,31.85],[1386655200000,31.41],[1386741600000,31.1],[1386828000000,31.09],[1386914400000,30.83],[1387173600000,31.11],[1387260000000,31.58],[1387346400000,31.84],[1387432800000,31.26],[1387519200000,31.5],[1387778400000,31.98],[1387864800000,32.099],[1388037600000,32.18],[1388124000000,32.39],[1388383200000,32.44],[1388469600000,32.511],[1388642400000,32.02],[1388728800000,32.17],[1388988000000,31.98],[1389074400000,32.14],[1389160800000,31.78],[1389247200000,31.46],[1389333600000,31.47],[1389592800000,31.38],[1389679200000,31.81],[1389765600000,32.25],[1389852000000,32],[1389938400000,32.4],[1390284000000,33.06],[1390370400000,33.32],[1390456800000,32.93],[1390543200000,32.12],[1390802400000,31.88],[1390888800000,32.35],[1390975200000,32.97],[1391061600000,33.54],[1391148000000,33.43],[1391407200000,32.53],[1391493600000,32.51],[1391580000000,32.34],[1391666400000,33.08],[1391752800000,33.69],[1392012000000,33.91],[1392098400000,34.39],[1392184800000,34.72],[1392271200000,34.73],[1392357600000,34.76],[1392703200000,34.89],[1392789600000,35.75],[1392876000000,35.65],[1392962400000,35.7],[1393221600000,35.91],[1393308000000,35.9],[1393394400000,36.14],[1393480800000,36.25],[1393567200000,36.31],[1393826400000,35.82],[1393912800000,36.6],[1393999200000,36.41],[1394085600000,36.29],[1394172000000,36.53],[1394427600000,36.44],[1394514000000,35.97],[1394600400000,36],[1394686800000,35.51],[1394773200000,35.29],[1395032400000,35.51],[1395118800000,35.96],[1395205200000,35.99],[1395291600000,37.04],[1395378000000,36.35],[1395637200000,35.76],[1395! 723600000! ,36.43],[1395810000000,35.91],[1395896400000,35.63],[1395982800000,35.45],[1396242000000,36.235],[1396328400000,36.43],[1396414800000,36.1],[1396501200000,36.4],[1396587600000,34.905],[1396846800000,34.51],[1396933200000,35.07],[1397019600000,35.37],[1397106000000,34.45],[1397192400000,33.81],[1397451600000,33.96],[1397538000000,34.11],[1397624400000,33.98],[1397710800000,34.46],[1398056400000,34.62],[1398142800000,34.74],[1398229200000,34.36],[1398315600000,34.1

35.66 (1y: +8%) $(function(){var seriesOptions=[],yAxisOptions=[],name='ALTR',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1373259600000,33.03],[1373346000000,33.58],[1373432400000,33.84],[1373518800000,34.5],[1373605200000,35.05],[1373864400000,34.81],[1373950800000,34.9],[1374037200000,35.08],[1374123600000,35.66],[1374210000000,35.51],[1374469200000,35.56],[1374555600000,35.47],[1374642000000,35.11],[1374728400000,35.2],[1374814800000,34.99],[1375074000000,34.9],[1375160400000,35.19],[1375246800000,35.56],[1375333200000,36.47],[1375419600000,36.41],[1375678800000,36.18],[1375765200000,36.22],[1375851600000,36.15],[1375938000000,36.26],[1376024400000,36.01],[1376283600000,36.12],[1376370000000,36.3],[1376456400000,35.56],[1376542800000,34.69],[1376629200000,35],[1376888400000,34.78],[1376974800000,34.71],[1377061200000,34.67],[1377147600000,34.58],[1377234000000,34.66],[1377493200000,35.15],[1377579600000,34.53],[1377666000000,34.79],[1377752400000,35.69],[1377838800000,35.17],[1378184400000,35.88],[1378270800000,37.225],[1378357200000,37.46],[1378443600000,37.57],[1378702800000,37.98],[1378789200000,38.645],[1378875600000,38.7],[1378962000000,38.8],[1379048400000,38.67],[1379307600000,37.85],[1379394000000,38.18],[1379480400000,38.14],[1379566800000,37.981],[1379653200000,37.6],[1379912400000,37.305],[1379998800000,37.36],[1380085200000,37.37],[1380171600000,37.3],[1380258000000,36.96],[1380517200000,37.16],[1380603600000,37],[1380690000000,36.84],[1380776400000,36.66],[1380862800000,36.87],[1381122000000,36.52],[1381208400000,36.09],[1381294800000,35.79],[1381381200000,36.725],[1381467600000,37.19],[1381726800000,37.31],[1381813200000,36.7],[1381899600000,37.03],[1381986000000,37.825],[1382072400000,37.48],[1382331600000,37.46],[1382418000000,37.32],[1382504400000,32.3],[1382590800000,33.175],[1382677200000,33.13],[1382936400000,33.45],[1383022800000,33.86],[1383109200000,33.475],[1383195600000,33.605],[1383282000000,33.17],[1383544800000,33.3],[1383631200000,32.97],[1383717600000,33.11],[138! 3804000000,33.13],[1383890400000,33.39],[1384149600000,32.929],[1384236000000,33.16],[1384322400000,33.18],[1384408800000,32.48],[1384495200000,32.72],[1384754400000,32.47],[1384840800000,31.06],[1384927200000,31.35],[1385013600000,32.01],[1385100000000,32.34],[1385359200000,32.24],[1385445600000,32.09],[1385532000000,32.52],[1385704800000,32.25],[1385964000000,32.05],[1386050400000,31.88],[1386136800000,31.97],[1386223200000,31.86],[1386309600000,32.12],[1386568800000,31.85],[1386655200000,31.41],[1386741600000,31.1],[1386828000000,31.09],[1386914400000,30.83],[1387173600000,31.11],[1387260000000,31.58],[1387346400000,31.84],[1387432800000,31.26],[1387519200000,31.5],[1387778400000,31.98],[1387864800000,32.099],[1388037600000,32.18],[1388124000000,32.39],[1388383200000,32.44],[1388469600000,32.511],[1388642400000,32.02],[1388728800000,32.17],[1388988000000,31.98],[1389074400000,32.14],[1389160800000,31.78],[1389247200000,31.46],[1389333600000,31.47],[1389592800000,31.38],[1389679200000,31.81],[1389765600000,32.25],[1389852000000,32],[1389938400000,32.4],[1390284000000,33.06],[1390370400000,33.32],[1390456800000,32.93],[1390543200000,32.12],[1390802400000,31.88],[1390888800000,32.35],[1390975200000,32.97],[1391061600000,33.54],[1391148000000,33.43],[1391407200000,32.53],[1391493600000,32.51],[1391580000000,32.34],[1391666400000,33.08],[1391752800000,33.69],[1392012000000,33.91],[1392098400000,34.39],[1392184800000,34.72],[1392271200000,34.73],[1392357600000,34.76],[1392703200000,34.89],[1392789600000,35.75],[1392876000000,35.65],[1392962400000,35.7],[1393221600000,35.91],[1393308000000,35.9],[1393394400000,36.14],[1393480800000,36.25],[1393567200000,36.31],[1393826400000,35.82],[1393912800000,36.6],[1393999200000,36.41],[1394085600000,36.29],[1394172000000,36.53],[1394427600000,36.44],[1394514000000,35.97],[1394600400000,36],[1394686800000,35.51],[1394773200000,35.29],[1395032400000,35.51],[1395118800000,35.96],[1395205200000,35.99],[1395291600000,37.04],[1395378000000,36.35],[1395637200000,35.76],[1395! 723600000! ,36.43],[1395810000000,35.91],[1395896400000,35.63],[1395982800000,35.45],[1396242000000,36.235],[1396328400000,36.43],[1396414800000,36.1],[1396501200000,36.4],[1396587600000,34.905],[1396846800000,34.51],[1396933200000,35.07],[1397019600000,35.37],[1397106000000,34.45],[1397192400000,33.81],[1397451600000,33.96],[1397538000000,34.11],[1397624400000,33.98],[1397710800000,34.46],[1398056400000,34.62],[1398142800000,34.74],[1398229200000,34.36],[1398315600000,34.1

The Supreme Court decision on whether employers must provide contraceptive coverage could affect more than just Hobby Lobby. NEW YORK (CNNMoney) The Supreme Court's decision on contraceptives and employer health plans could affect companies and workers far beyond Hobby Lobby and the other plaintiffs.

The Supreme Court decision on whether employers must provide contraceptive coverage could affect more than just Hobby Lobby. NEW YORK (CNNMoney) The Supreme Court's decision on contraceptives and employer health plans could affect companies and workers far beyond Hobby Lobby and the other plaintiffs.