Shutterstock At some point during each of our professional lives, we wake up to the fact that we really need to be saving for retirement. We're all going to retire, and that means we're all going to need some money put aside for retirement. The problem is that when we think broadly about saving for retirement, it seems impossible. A million dollars? More? How are we going to possibly come up with that kind of money? Here's the catch: None of those retirement articles out there -- the ones that talk about having to save millions -- are writing about your situation. Instead, they're writing about someone else, often someone earning a lot more than you. What you need is a plan that works for you, and that starts with having a good target number for retirement savings. To calculate your retirement number all you need is your most recent Social Security statement along with how much you made in the past year as well as the number of years between now and when you plan to retire. You'll also need a web browser with Google ready to go and a piece of scratch paper. Ready? Step 1. The first thing you need to figure out is what your current salary will look like when you retire because this whole plan is based on the idea that you'll live on your current income when you retire. If you plan on living on 80 percent of your salary or another percentage, head to Google right now and type in "80 percent of $40,000" or whatever your current salary is. I usually suggest people use 80 percent of their salary for their retirement number because they will no longer have work-related expenses. Step 2. Expect that long-term inflation will be 3 percent, which is based on a high-end estimate from the Federal Reserve. So, you should go to Google and type in "1.03^" followed immediately by the number of years between now and when you expect to retire. So, if you expect to retire in 18 years, you'd type in 1.03^18. Now, take that number and multiply it by your salary (or whatever you decide to use above). If you're using Google, a calculator should appear with the first number already entered for you. If you were using $32,000 per year (80 percent of $40,000) and you're retiring in 18 years, for example, it will give you $54,477, which is what your salary will look like in 18 years with normal inflation. Step 3. From that number, you need to subtract what you'll receive annually from Social Security, so pull out your Social Security statement and look for your annual benefit. Subtract that from your salary above. In this example, a person might have an annual benefit of $15,000 from Social Security, so his or her new number would be $39,477. Step 4. Now, that annual amount is going to have to last you for awhile. I usually assume people will spend an average of 25 years in retirement, but their investments will continue to earn a return while they're retired. So, I tell people to multiply that salary number by 20, which is your final step. Therefore, a person who makes $40,000 per year and is 18 years from retirement needs to save $789,540 for retirement. This is a quick calculation, of course, but saving enough to hit your number isn't as scary as you might think, particularly if you're far from retirement. This person, who receives a 1:1 employer match on his or her 401(k) up to 6 percent, and hits all of that while also fully funding a Roth individual retirement account each year, would be close to on pace for that number. Someone starting to save earlier might not even have to push that hard. Someone starting later might have to save even more or consider waiting a year or two longer to retire. The lesson of this story is simple: Start saving now. You're going to need quite a bit of money to retire, and every year you put it off the harder you make your savings journey.

Shutterstock At some point during each of our professional lives, we wake up to the fact that we really need to be saving for retirement. We're all going to retire, and that means we're all going to need some money put aside for retirement. The problem is that when we think broadly about saving for retirement, it seems impossible. A million dollars? More? How are we going to possibly come up with that kind of money? Here's the catch: None of those retirement articles out there -- the ones that talk about having to save millions -- are writing about your situation. Instead, they're writing about someone else, often someone earning a lot more than you. What you need is a plan that works for you, and that starts with having a good target number for retirement savings. To calculate your retirement number all you need is your most recent Social Security statement along with how much you made in the past year as well as the number of years between now and when you plan to retire. You'll also need a web browser with Google ready to go and a piece of scratch paper. Ready? Step 1. The first thing you need to figure out is what your current salary will look like when you retire because this whole plan is based on the idea that you'll live on your current income when you retire. If you plan on living on 80 percent of your salary or another percentage, head to Google right now and type in "80 percent of $40,000" or whatever your current salary is. I usually suggest people use 80 percent of their salary for their retirement number because they will no longer have work-related expenses. Step 2. Expect that long-term inflation will be 3 percent, which is based on a high-end estimate from the Federal Reserve. So, you should go to Google and type in "1.03^" followed immediately by the number of years between now and when you expect to retire. So, if you expect to retire in 18 years, you'd type in 1.03^18. Now, take that number and multiply it by your salary (or whatever you decide to use above). If you're using Google, a calculator should appear with the first number already entered for you. If you were using $32,000 per year (80 percent of $40,000) and you're retiring in 18 years, for example, it will give you $54,477, which is what your salary will look like in 18 years with normal inflation. Step 3. From that number, you need to subtract what you'll receive annually from Social Security, so pull out your Social Security statement and look for your annual benefit. Subtract that from your salary above. In this example, a person might have an annual benefit of $15,000 from Social Security, so his or her new number would be $39,477. Step 4. Now, that annual amount is going to have to last you for awhile. I usually assume people will spend an average of 25 years in retirement, but their investments will continue to earn a return while they're retired. So, I tell people to multiply that salary number by 20, which is your final step. Therefore, a person who makes $40,000 per year and is 18 years from retirement needs to save $789,540 for retirement. This is a quick calculation, of course, but saving enough to hit your number isn't as scary as you might think, particularly if you're far from retirement. This person, who receives a 1:1 employer match on his or her 401(k) up to 6 percent, and hits all of that while also fully funding a Roth individual retirement account each year, would be close to on pace for that number. Someone starting to save earlier might not even have to push that hard. Someone starting later might have to save even more or consider waiting a year or two longer to retire. The lesson of this story is simple: Start saving now. You're going to need quite a bit of money to retire, and every year you put it off the harder you make your savings journey.

Eneryg Stocks To Invest In 2013, Best Energy Stocks For 2013

Tuesday, March 31, 2015

4 Steps to Quickly Figure Out Your Retirement Number

The Unique Ways Women Approach Finance

There Are Differences

In an interview with the NZZ, Christine Schmid of Credit Suisse explains that the sub-discipline of gender finance deals with the social differences between men and women. Anja Peter, of Bank Coop in Switzerland concurs that "naturally, there are differences between men and women, biologically and socially, and this is reflected in investment behavior." For instance, women are generally more interested in such issues as ecology, ethics and microcredits. However, when it comes to the crunch, this interest does not always impact on the actual investment decision.

A study conducted at the Centre for Financial Research at the University of Cologne found that female fund managers switch around their portfolios less than their male colleagues. Furthermore, women's strategies and the subsequent performance tend to be more stable.

Historically, women have had less to do with financial decisions than men and their investment volume has also been lower. However, that is changing. Find out about one lady that bucked historical trends in Hetty Green: The Witch Of Wall Street.

Female Risk Aversion?

Recent studies shed new light on the typical investment behavior of women. The German Institute for Economic Research (DIW) recently evaluated data from more than 8,000 men and women.

At first glance, the study seems to confirm the standard view, but not all that strongly, as 38% of women have risky financial products such as stocks, whereas it is 45% for men.

However, the DIW does not believe this confirms an inherent risk aversion on the part of women. A regression analysis reveals that women would take more risk if they had more money. Women generally still have only have about half as much to invest as men, which inevitably compels them to be more cautious; that may be the real reason for the apparent risk aversion.

Career Barriers and the Glass Ceiling

In the same vein, there are still few women applying for jobs or working as financial researchers or brokers. Schmid believes that women continue to gravitate to where there are other women, but hopes that these barriers will break down over time. Clearly, there is a link between the career side of the gender equation and investment behavior.

Lower Self Confidence, but Higher Performance

Interestingly, studies by the German Comdirect Bank and the DAB reveal that, while women have less confidence in their financial knowledge than men, this is not matched by poorer investment choices and management. The study revealed that 58% of men rated their financial understanding as good or very good, but only 47% of women. Furthermore, a large sample of almost half a million private portfolios demonstrates that in 2007 and the crisis year of 2008, women did 4 to 6% better than men.

The Road Ahead

Over time, these differences are likely to decline, but not disappear altogether. After all, there are centuries of entrenched gender roles, and elements still remain and are likely do so to some extent for the foreseeable future. Furthermore, given that women are genetically the child bearers, some aspects of the male-female roles are intrinsically fixed by nature. Thus, more women than men will still find it harder to invest in the true sense of the word.

Nonetheless, we can certainly expect the behavioral trends to diminish. After all, never before have there been so many highly qualified women who earn well, have money to invest and want do so securely and appropriately. Furthermore, many observers (and studies) state that women often invest remarkably well.

This in turn will lead to more programs that focus on female investors. The Swiss Bank Coop, with its Project Eva, is a classic example, and is sure to be followed by many others over time. The presence of female investment clubs, on the Internet and beyond, constitutes another sign of the times.

Barbara Aigner, of Emotion Banking in Austria, believes in a specifically female customer segmentation, which looks like yet another way ahead. She divides the female customer segment into three groups of "self-conscious, pleasure oriented" younger women, an "interested and open-minded active group" of women who are more interested in what the bank offers and the "traditional conservatives" who are loyal and risk averse.

The Bottom Line

It is really only in the 20th century that women have managed to break down many of the barriers in a male-dominated world. The role to which women have been relegated has constrained both their financial knowledge and activities. This situation is changing constantly. Nonetheless, some of the clichés are entrenched in the mind and some elements of the old role inevitably remain intact in practice. In any event, understanding gender differences and how they are changing over time - and catering effectively for them - is fundamental to understanding and managing the world of investment.

Sunday, March 29, 2015

The Incredible Shrinking Deficit

According to an LA Times article in 2011: "Some 75% of respondents said they were following the [California] budget debate, yet only 16% were aware that state spending has shrunk by billions of dollars over the last three years."

There may be something similar happening now at the federal level. Poll after poll will confirm that Americans are worried about the budget deficit. But how many of them know it's shrinking fast?

The Treasury Department issues reports on monthly spending and tax receipts -- a version of the government's income statement. Tally up the last four years, and you get this:

Source: Treasury Department.

Many have pleaded with the government to cut spending. Far fewer, I think, know that the government spent less over the last 12 months than it did during the same period two years ago. Adjusted for inflation, the government spent the exact same amount over the past 12 months as it did during the same period five years ago, before the current administration came into office.

If you just look at the first three months of the year, which is guided by the most recent deficit-reduction policies, the numbers are even better for deficit hawks. Compared with the first three months last year, federal spending is down 9%, tax receipts are up 14%, and the deficit is down 32%.

Goldman Sachs analyst Alex Phillips recently wrote:

The federal deficit continues to shrink. Through the first six months of the fiscal year, revenues have come in higher than expected, while spending has come in lower than expected. As a result we are lowering our deficit forecast for the current and next two fiscal years.

Earlier this year we lowered our FY2013 deficit forecast from $900bn (5.6% of GDP) to $850bn (5.3%). In light of recent trends, we are lowering it again to $775bn (4.8%) ...

We expect the improvement to continue for the next few years. Although we had already expected additional cyclical improvement and residual fiscal policy tightening to reduce the deficit further in 2014 and 2015, we have reduced our estimates a bit further, to $600bn (3.5% of GDP) and $475bn (2.7%).

The most important figure here is the deficit as a share of GDP, because as long as a government's deficit is lower than annual economic growth, it can run in the red forever while actually lowering its debt burden (people overlook this because it doesn't apply to households). Since 1930, the government has run an average deficit equal to 3.2% of GDP each year.

Goldman now estimates the deficit as a share of GDP will total 4.8% this fiscal year, and 3.5% next year. Over the last year, GDP grew by 4%. If growth stays pat and Goldman's estimates are right, the nation's debt-to-GDP ratio will stop rising as soon as next fiscal year (which begins this October).

Long term, the largest budget issue is the cost of health care its impact on Medicare. It will be a mammoth problem if not addressed. But the short- and medium-term budget outlook is likely far tamer than most imagine. Just like California in 2011, there is a gulf between perception and progress.

Thursday, March 26, 2015

Is This Apple Stock Position Still Worth Holding?

Each week, I endeavor to report the results of the Big Idea Portfolio, a collection of five tech stocks that I believe will crush the market over a three-year period. I've done it before; my last tussle with Mr. Market ended with me beating the index's average return by 13.35%.

Real money was on the line then as it is now, which means any one of the five stocks you see below could cause me a lot of public embarrassment. Apple (NASDAQ: AAPL ) has caused the most trouble over the past several months. Count this week's 3.5 percentage-point drop as the latest dip.

Apple's stock price has fallen more than 33% over the past 12 months and is down 20% year to date, despite an 8% rise in the S&P 500. Holding in hopes of seeing CEO Tim Cook and his team make good on long-promised innovations in delivering televised entertainment has cost me dearly.

Bullish investors will nevertheless tell you that Apple stock looks like a bargain at current prices. They're right. Google and Microsoft (NASDAQ: MSFT ) both trade at a noticeable premium to Apple when you factor in liquid assets:

AAPL Price to Earnings Less Cash TTM data by YCharts.

Selling now would amount to declaring that the Mac maker is incapable of generating even 10% annual earnings growth for the foreseeable future. Analysts are modeling for 18.9% annual gains over the next five years, according to Yahoo! Finance.

A decade of investing has taught me that winning is less a matter of wits and more a matter of willpower. Apple is testing my will to hold, so I shall.

What's the Big Idea this week?

Elsewhere, Google and Riverbed Technology barely budged as my other two tech holdings plunged, costing me another 420 basis points in my three-year battle with Mr. Market. Among the indexes, only the Dow reported a marginal 0.19% gain.

This time, the Russell 2000 led the laggards with a 2.72% decline, followed by the Nasdaq's 1.30% drop, and the S&P 500's 0.59% dip, according to data supplied by The Wall Street Journal. Here's a closer look at where I stood through Thursday's close:

| Company | Starting Price* | Recent Price | Total Return |

| Apple | $416.26** | $427.72 | 2.8% |

| | $650.09 | $795.07 | 22.3% |

| Rackspace Hosting | $41.65 | $46.86 | 12.5% |

| Riverbed Technology | $25.95 | $14.96 | (42.4%) |

| Salesforce.com | $100.93 | $166.41 | 64.9% |

| AVERAGE RETURN | -- | -- | 12.02% |

| S&P 500 SPDR | $124.39** | $155.86 | 25.29% |

| DIFFERENCE | -- | -- | (13.27%) |

Source: Yahoo! Finance.

*Tracking began at market close on Jan. 6, 2012.

**Adjusted for dividends and other returns of capital.

Notable newsmakers

Among the other tech stocks making news last week:

Facebook (NASDAQ: FB ) took its fight with Google to next level by introducing "Home," an overlay for Android phones that assumes control of a handset's home and lock screen. An accompanying "cover feed" reveals what friends are up to while making chat accessible from any app or screen.

Tesla Motors (NASDAQ: TSLA ) soared this week after the company said Model S sales came in at 4,750, above the 4,500 projected earlier. The company also forecast a surprise first-quarter profit. Tesla next reports earnings on May 6.

Finally, in yet another sign of weakness in the telecom sector, F5 Networks (NASDAQ: FFIV ) on Thursday night lowered second quarter-guidance because of sharp declines in sales to carriers to federal agencies. Revenue is now expected to fall sequentially and grow just 3% year over year. The stock fell more than 17% in Friday morning trading.

What's caught your eye in the tech world? Do you believe Apple's stock price will rebound ahead of earnings, or are we in for more losses? Let us know what you think in the comments box below.

It's incredible to think just how much of our digital and technological lives are almost entirely shaped and molded by just a handful of companies. Find out Who Will Win the War Between the 5 Biggest Tech Stocks" in The Motley Fool's latest free report, which details the knock-down, drag-out battle being waged among the five kings of tech. Click here to keep reading.

Monday, March 23, 2015

Royce Funds' Jay Kaplan – The State Of Small-Cap Valuations and Holding High Confidence Names

As someone who buys stocks with a business-buyer's perspective, what have been your biggest challenges through the first nine months of the year?

I think the biggest challenge is the state of small-cap valuations – as a whole they look high enough to me that even an additional decline in the 5-10% range would probably not create a plethora of great bargains unless, over time, we see earnings grow at a more robust pace than stock prices, which would change multiples and thus create some opportunities.

However, given that the economy continues to chug along at a modest pace and employment numbers continue to slowly improve, I'm not sure that we'll see small-cap share prices drop to attractively discounted levels any time soon.

Of course, there could be a shock – a geopolitical or other event that triggers a significant sell-off. Otherwise, however, very few companies look undeservedly cheap right now – most low-multiple stocks look cheap for very good reasons.

An accommodative Fed and a growing economy make it hard for me to see the valuation picture shifting much over the next several months. So I've been staying with old favorites at higher valuations than I would normally like.

But today, it's an easy choice to make between holding a high-confidence pick and rooting around in the bargain bin where very little looks good.

Can you give two examples of high-confidence picks that have done well so far in 2014?Two Energy companies – Helmerich & Payne and Unit Corporation.

Both were terrific performers in the first half. Each corrected a bit in the third quarter when oil prices were slipping, though they remained among Royce Value Fund's top performers year-to-date through the end of September.

Helmerich & Payne is an old Royce favorite that provides contract drilling of oil and gas wells and operates land and platform rigs. New orders for its technologically advanced rigs continue to come in at an accelerating rate – the opposite of what happened in 2013.

With business booming, the company continues to take market share while attracting customers who don't mind paying a little more for Helmerich's higher-quality products. The company also has a great reputation for quality in terms of its crews and drilling efficiency. It's a perfect example of a high-confidence company.

Unit Corporation is another great example. It goes against the grain in terms of its business model because it is both an oil and gas producer and an energy services business.

Wall Street traditionally looks at these businesses separately so by doing both Unit has always been an anomaly. We've liked the company for many years because it has historically been successful across all of these related business lines.

So far in 2014, its E&P (exploration & production) business has recovered nicely, its midstream business that transports and processes natural gas has been doing very well, and its drilling business, like Helmerich & Payne's, has improved. In addition, Unit's new BOSS rigs have seen a pick-up in demand.

Can you talk about a company that has struggled a bit this year but that you still think has strong long-term prospects?The first name I thought of was Atwood Oceanics because it's also an Energy company, but it hasn't yet enjoyed the kind of success that Helmerich & Payne or Unit have so far in 2014.

It's a good example of why we generally don't make sector bets at Royce—not every stock in a sector or industry is going to perform the same way.

So first and foremost we're stock pickers who prefer to look at companies from the bottom up. And on that fundamental basis, I see a lot to like about this company in spite of the fact that it's lagged some of its small-cap sector peers this year.

Unlike Unit and Helmerich & Payne, Atwood is an offshore drilling contractor that specializes in deep-water drilling. That area of the drilling business has suffered from an oversupply problem that has put pressure on pricing for both rigs and drill ships.

The company's rigs that are currently under customer contracts provide for a very solid 2014 and go a long way toward providing visibility into 2015's results. However, the company is also taking delivery of two large new drill ships in 2015 for which it does not yet have contracts, and this has the market worried.

I think most of this anxiety is reflected in the stock's price. I also think it is reasonable to assume that Atwood will find work for these state of the art, high-quality ships (although the pricing could be pressured), which should boost the stock price.

Finally, I like that the company has recently initiated a dividend with a stated goal to increase it over time.

Another company that I think has promise is Convergys Corporation, which is based in Cincinnati and runs a global call-center business. Earlier

Thursday, March 19, 2015

WD-40 Company Misses Q3 Estimates; Provides FY2014 Guidance (WDFC)

After the closing bell on Wednesday, WD-40 Co. (WDFC

) released its third quarter earnings, posting slightly higher revenues and net income than last year’s Q3.

) released its third quarter earnings, posting slightly higher revenues and net income than last year’s Q3.

WDFC’s Earnings in Brief

WD-40 reported third quarter revenues of $95.65 million, up from last year’s Q3 revenues of $93.1 million. Net income for the quarter came in at $10.4 million, or 69 cents per share, up slightly from last year’s Q3 figures of $10.27 million, or 66 cents per share. WD-40 missed analysts’ estimates of 72 cents EPS on revenues of $99.16 million. Looking ahead, WDFC sees FY2014 EPS in the range of $2.70-$2.83 on revenues between $380 million and $387 million, while analysts are expecting EPS of $2.75 on revenues of $387.44 million.CEO Commentary

WD-40′s president and CEO Garry Ridge released the following comments in the earnings release: “We are pleased with the solid progress we have made for the year and remain confident that our strategic initiatives are well positioned to carry us into the future. While we continue to see fluctuations in certain markets quarter to quarter, our long-term growth plans remain stable and we continue to deliver on our expectations.”

WDFC’s Dividend

WD-40 declared its last quarterly dividend of 34 cents on June 24. The dividend is payable on July 31, and the stock goes ex-dividend today, July 9.

Stock Performance

WDFC stock ended the trading day up 45 cents, or 0.59%, but the stock was headed slightly lower in after hours trading. YTD, the company’s stock is up 2.24%.

WDFC Dividend SnapshotAs of Market Close on July 9, 2014

Click here to see the complete history of WDFC dividends.

Tuesday, March 17, 2015

How Intel and Caterpillar Became the Dow's 1st-Half Winners

Monday marked the end of the second quarter, and the Dow Jones Industrials (DJINDICES: ^DJI ) failed to rise to the occasion, falling 25 points. The Dow has had a fairly flat performance so far in 2014, gaining just over 1% and making many investors question whether the bull market has the staying power it would need to provide the sixth-straight year of positive returns for the Dow. Yet even amid the lackluster gains for the Dow overall, Intel (NASDAQ: INTC ) and Caterpillar (NYSE: CAT ) have helped the Dow avoid losses for the year, with each of the Dow components gaining more than 20% in the first half. Let's take a closer look at how they did it.

Total Return Price data by YCharts

Source: Intel.

Intel's gains have stemmed from the fact that the chipmaker has been in the right place at the right time, with a confluence of positives helping to bolster the tech giant's future prospects. On one hand, Intel has finally stepped up to the plate in the mobile space, with efforts to create viable chips for both high-end applications as well as more affordable lower-end devices that can help to meet demand in emerging markets where cost is a much more important concern. At the same time, though, Intel got a positive surprise from a product-upgrade cycle, with older PC users finding themselves having to upgrade in order to keep getting support for key operating-system software. PC sales aren't likely to sustain their upward track for long, but efforts in the direction of becoming a bigger player in mobile could serve Intel well for years to come.

Caterpillar's jump, meanwhile, has come as investors finally concluded that the maker of heavy equipment had just about hit bottom. After years of sluggish construction-equipment sales, the plunge in commodity prices last year sent mining-equipment demand through the floor as well. But equipment dealers have started to see signs of life from their customers, with government spending starting to pick up and a tight rental market making new-equipment purchases look more attractive on a relative basis. Caterpillar still needs to see improvement in economic conditions in other key markets, especially China, but after long periods of underperformance, Caterpillar stock might finally be making the run shareholders have waited for.

Investors in the Dow Jones Industrials would obviously like to see better performance from the average in the second half. For shareholders of Dow components Intel and Caterpillar, though, just holding onto the first half's gains would be victory enough for a solid 2014.

Imagine a company that rents a very specific and valuable piece of machinery for $41,000 per hour. (That's almost as much as the average American makes in a year!) And Warren Buffett is so confident in this company's can't-live-without-it business model, he just loaded up on 8.8 million shares. An exclusive, brand-new Motley Fool report details this company that already has over 50% market share. Just click here to discover more about this industry-leading stock, and join Buffett in his quest for a veritable landslide of profits!

Monday, March 16, 2015

Apple Inc Prepares to Put Samsung and Google to Shame With Its Upcoming iWatch

Although we're only halfway through the year, 2014 could very well turnout to be the "Year of Apple (NASDAQ: AAPL ) " in technology circles.

Source: U.S. PTO

Thus far, investors have shown a renewed interest in the world's largest publicly traded company, and for good reason. After issuing its most impressive earnings report in some time, with another likely around the corner, Apple is now pushing full-steam ahead into a second half product launch cycle that should include notable growth drivers like the iPhone 6 and the iWatch.

And speaking of the iWatch, an entirely new set of details have recently emerged that speak to the fact, once again, that Apple is set to raise the bar high in the emerging wearables category.

Inside Apple's iWatch report

On Friday, a story in The Wall Street Journal shed light on several key aspects of Apple's upcoming iWatch that had yet to be discussed. According to the Journal's reporting, the Apple iWatch will come in several different versions, presumably different styles, shapes, and sizes.

This doesn't give investors much in the way of specifics, but Apple investors should still find it encouraging. One of the underappreciated challenges any tech company entering the smartwatch space will have to navigate is that watches are also a fashion accessory, more so than any other major consumer electronics segment to date. In order to win over a mass audience, tech firms like Apple will not only need to create an amazing piece to technology, but also package it in an attractive enough fashion that people will want to wear it. It's a subtle point, but a critical one.

In my mind, the fact that Apple plans to cater to various styles and tastes with the iWatch probably bodes well for its chances at mass adoption. Apple has always excelled at product design, but this could also be a subplot that finally shows where former Yves Saint Laurent Chief Executive Officer and current Apple mystery employee Paul Deneve fits into the iWatch equation as well. That's a bit of plausible speculation, but judging by this new detail the real point is that Apple appears to be keenly aware of the fashion requirements it will need to fulfill with the iWatch..

How many sensors was that?

The Journal report also asserted that Apple's smartwatch design will feature at least 10 integrated sensors that will help Apple achieve a level of biometric and health data monitoring well above what the competition currently offers. This integrated sensor storyline is by no means new, but the fact that Apple plans to pack so many sensors into the iWatch is a new detail to this storyline, and an exciting one at that.

As was the case with the sizes/styles storyline, this new wrinkle also comes up short in the way of specifics, but still helps set a positive expectation for the iWatch. I think it's safe to say that smartwatches have a long way to go to truly fulfill the category's potential, and I've argued plenty of times in recent months that Apple is by far the best suited company to make the kind of "great leap forward" it will require to grow the smartwatch beyond just a niche for enthusiasts. The key here, beyond fashion sensibilities, will be usefulness. And in that regard, the fact that Apple plans to pack 10 or more sensors into the iWatch implies that it has much more than just a heartbeat sensor in store with the iWatch. Again, we don't know what those extra sensors will go toward, but it definitely bodes well for the iWatch clearing the critical usefulness hurdle as well.

Leaked: Apple's next smart device (warning, it may shock you)

Apple recently recruited a secret-development "dream team" to guarantee its newest smart device was kept hidden from the public for as long as possible. But the secret is out, and some early viewers are claiming its everyday impact could trump the iPod, iPhone, and the iPad. In fact, ABI Research predicts 485 million of this type of device will be sold per year. But one small company makes Apple's gadget possible. And its stock price has nearly unlimited room to run for early in-the-know investors. To be one of them, and see Apple's newest smart gizmo, just click here!

5 Things to Accomplish in Retirement

After dealing with the many challenges of your career, you may find yourself craving some time to do nothing at all in retirement. You might want nothing more than to slow down and take life as it comes. But after the initial honeymoon period of retirement has run its course and you have had time to decompress a bit, you may start thinking about how to occupy yourself for the next 20 or more years. You will have many years at your disposal, and you need to decide what activities you would like to focus on. Here are five retirement goals to consider: Second career. For some people retirement offers the chance to finally change careers. A job that left you feeling underappreciated can be replaced with an entirely new pursuit. Without the financial burden of making ends meet, you can pursue a second career that focuses on what you really enjoy doing. And retirement jobs don't necessarily have to be full time. You could find a position with an abbreviated work week or work only part of the year. Best of all, if for some reason your new job does not work out, you can walk away and find something else that better suits your preferences. Reinvent yourself. If a new career is not for you, retirement may be the perfect time to reinvent yourself. Not all of the skills you developed on the job necessarily translate well into life as a retiree. Working long hours and racking up achievements often serves you well in the workplace, but could make it difficult to relax and take life slower in retirement. When you are no longer forced to conform to the requirements of a job, you are free to focus on aspects of your personality that better equip you to enjoy retired living. Volunteer. Volunteering can be a way for you to use skills developed for your business life outside of the corporate grind. Working for a cause that inspires you can make your retirement much more fulfilling. Many retirees generously offer their time to worthy causes. Take your time to find the right opportunity for you. When you find a great volunteer position, everyone involved wins. Create. Retirement can allow you to pay more attention to your creative side. Many working folks are forced to hold back their creative energies because they don't have time for it. In retirement you can unleash the writer, singer, actor or painter you always wanted to be. And since you are free from requirements to provide a living, your success can be measured in the pleasure you experience pursuing your passion. Relax. You don't necessarily have to do something meaningful or significant every day of your retirement. You are free to do as much or as little as you want. As long as you enjoy what you do with your time your retirement is a success. There is always room for some down time in a balanced retirement. When I was in my sales career, we constantly talked about goals. We often set stretch goals designed to make you push yourself beyond what you believed yourself capable of doing. But now I cannot remember a single stretch goal from my working days. Now I look forward to creating goals that matter to me personally instead of the company. The beauty of retirement is there is only one person measuring your success against the goals you set -- you. Enough already with aggressive goals and impossible deadlines. If you miss the target your job is not on the line. Should you decide you want to change direction, you require no approval by committee and can just do it. Retirement goals can be helpful guidelines to focus your efforts and inspire your days and are not rigid requirements. In retirement you get to decide what you want to do. If you want to make productive use of your time as a retiree you have many options to volunteer, create something new or work at a second career on your own terms. But if none of those options appeals to you, you can even decide to do nothing at all. .

After dealing with the many challenges of your career, you may find yourself craving some time to do nothing at all in retirement. You might want nothing more than to slow down and take life as it comes. But after the initial honeymoon period of retirement has run its course and you have had time to decompress a bit, you may start thinking about how to occupy yourself for the next 20 or more years. You will have many years at your disposal, and you need to decide what activities you would like to focus on. Here are five retirement goals to consider: Second career. For some people retirement offers the chance to finally change careers. A job that left you feeling underappreciated can be replaced with an entirely new pursuit. Without the financial burden of making ends meet, you can pursue a second career that focuses on what you really enjoy doing. And retirement jobs don't necessarily have to be full time. You could find a position with an abbreviated work week or work only part of the year. Best of all, if for some reason your new job does not work out, you can walk away and find something else that better suits your preferences. Reinvent yourself. If a new career is not for you, retirement may be the perfect time to reinvent yourself. Not all of the skills you developed on the job necessarily translate well into life as a retiree. Working long hours and racking up achievements often serves you well in the workplace, but could make it difficult to relax and take life slower in retirement. When you are no longer forced to conform to the requirements of a job, you are free to focus on aspects of your personality that better equip you to enjoy retired living. Volunteer. Volunteering can be a way for you to use skills developed for your business life outside of the corporate grind. Working for a cause that inspires you can make your retirement much more fulfilling. Many retirees generously offer their time to worthy causes. Take your time to find the right opportunity for you. When you find a great volunteer position, everyone involved wins. Create. Retirement can allow you to pay more attention to your creative side. Many working folks are forced to hold back their creative energies because they don't have time for it. In retirement you can unleash the writer, singer, actor or painter you always wanted to be. And since you are free from requirements to provide a living, your success can be measured in the pleasure you experience pursuing your passion. Relax. You don't necessarily have to do something meaningful or significant every day of your retirement. You are free to do as much or as little as you want. As long as you enjoy what you do with your time your retirement is a success. There is always room for some down time in a balanced retirement. When I was in my sales career, we constantly talked about goals. We often set stretch goals designed to make you push yourself beyond what you believed yourself capable of doing. But now I cannot remember a single stretch goal from my working days. Now I look forward to creating goals that matter to me personally instead of the company. The beauty of retirement is there is only one person measuring your success against the goals you set -- you. Enough already with aggressive goals and impossible deadlines. If you miss the target your job is not on the line. Should you decide you want to change direction, you require no approval by committee and can just do it. Retirement goals can be helpful guidelines to focus your efforts and inspire your days and are not rigid requirements. In retirement you get to decide what you want to do. If you want to make productive use of your time as a retiree you have many options to volunteer, create something new or work at a second career on your own terms. But if none of those options appeals to you, you can even decide to do nothing at all. .

Saturday, March 14, 2015

What we want Apple to unveil at WWDC

What will Tim Cook announce at WWDC this week? Here's what to expect. NEW YORK (CNNMoney) Tim Cook & Co. are set to take the stage Monday at Apple's annual Worldwide Developers Conference in San Francisco to unveil the tech titan's latest and greatest iStuff.

What will Tim Cook announce at WWDC this week? Here's what to expect. NEW YORK (CNNMoney) Tim Cook & Co. are set to take the stage Monday at Apple's annual Worldwide Developers Conference in San Francisco to unveil the tech titan's latest and greatest iStuff. We take a look at what Apple (AAPL) is likely to announce, what it probably won't introduce ... and what we wish the company would do.

Here's what to expect:

IOS 8. As has been the case for the past several years, Apple will almost certainly lift the curtain on its latest iPhone and iPad operating system.

The changes are widely expected to be far more subtle than in years past. After last year's complete makeover, iOS 8 is expected to include oft-requested fixes, such as an improved Maps app with transit directions, simplified notifications and a separate iTunes Radio app.

The biggest addition to iOS 8 could be a new Healthbook application, which was first reported by 9to5Mac. The app will likely monitor users' heart rates, sleep, activity and breathing among other health-related information. It may connect to third-party monitoring devices, such as the FitBit, or it could eventually work in tandem with Apple's long-rumored iWatch. (More on that later).

Connected home. Apple could also unveil a new platform that would enable people to control all the items in their homes with the iPad or iPhone.

You can already control many connected devices with an iPhone or iPad, but Apple would likely simplify the process by allowing users to manage all their lights, appliances, thermostats and door locks with their iGizmos.

Mac OS X 10.10. How big a fan of iOS 7's flat design are you? That may determine whether or not you like the new Mac OS X.

Apple's designer-in-chief Jony Ive has been widely reported to be spearheading a redesign of OS X that makes the interface for Macs look much more iPhone- and iPad-like.

Real reason Apple is buying Beats

Real reason Apple is buying Beats New Macs. Apple is expected to release new iMacs less than a year after their latest update. And since the MacBook Air does not support Apple's ultra-sharp Retina Display,! a revamped MacBook Air is a strong possibility too.

And here's what not to expect:

New iPhones. Apple hasn't unveiled new iPhones at WWDC in several years. The event has become largely software-focused, and Apple isn't expected to introduce its new iPhone 6 (or whatever it will be called) until August.

New Apple TV. Not gonna happen. Apple has plenty of big announcements to make on Monday. While it is probably going to update its Apple TV set-top box eventually, it probably doesn't want that news to be overshadowed by iOS 8 and Mac OS X 10.10.

And you can forget Apple saying anything about the tech unicorn that is the iTV, Apple's long-rumored all-in-one miracle television that will change the face of media and TV forever. That's not getting announced anytime soon -- if ever.

The iWatch. Sorry, not this time. Though an iWatch could still hit store shelves this year, expect that to be paired with the iPhone 6. Maybe the iWatch will be Tim Cook's first "and one more thing..." announcement in August?

Here's what we wish Apple would announce:

Mobile payments. With its iBeacon technology, Apple could really be the first company to make mobile payments a reality in the United States.

IBeacon allows retailers to charge people for items using Bluetooth, meaning you don't have to tap, swipe or really do anything except be present to pay. The Wall Street Journal reported earlier this year that Apple is in the midst of rolling out a mobile payments platform.

A friendlier iCloud. Apple's iCloud remains a confusing mess for iPhone and iPad users. There's practically nothing that iCloud does better than competing services from Google (GOOGL), Microsoft (MSFT), Dropbox or many others. We wish Apple would announce an iCloud fix on Monday, but we're not holding our breath.

Apple should take a giant step back and answer this difficult question: What is iCloud? Is it a cloud-based storage system? A platform for its online services? ! An app un! to itself?

Then Apple can focus on fixing iCloud's sea of menus, confusing storage and backup requirements, and awful iTunes Match software.

Dr. Dre as WWDC's musical guest. This one's not outside the realm of possibility since Apple finally inked its $3 billion deal for Beats Electronics. Apple often has a musical guest perform at the end of its shows. If Dre really is the performer, let's hope Apple has someone manning the bleep button.

Wednesday, March 11, 2015

4 Hot Tech Stocks to Trade (or Not)

BALTIMORE (Stockpickr) -- Put down the 10-K filings and the stock screeners. It's time to take a break from the traditional methods of generating investment ideas. Instead, let the crowd do it for you.

>>5 Mega-Cap Stocks to Trade for Gains

From hedge funds to individual investors, scores of market participants are turning to social media to figure out which stocks are worth watching. It's a concept that's known as "crowdsourcing," and it uses the masses to identify emerging trends in the market.

Crowdsourcing has long been a popular tool for the advertising industry, but it also makes a lot of sense as an investment tool. After all, the market is completely driven by the supply and demand, so it can be valuable to see what names are trending among the crowd.

While some fund managers are already trying to leverage social media resources like Twitter to find algorithmic trading opportunities, for most investors, crowdsourcing works best as a starting point for investors who want a starting point in their analysis. Today, we'll leverage the power of the crowd to take a look at some of the most active stocks on the market today.

>>5 Stocks Under $10 Set to Soar

These "most active" names are the most heavily-traded names on the market -- and often, uber-active names have some sort of a technical or fundamental catalyst driving investors' attention on shares. And when there's a big catalyst, there's often a trading opportunity.

Without further ado, here's a look at today's stocks.

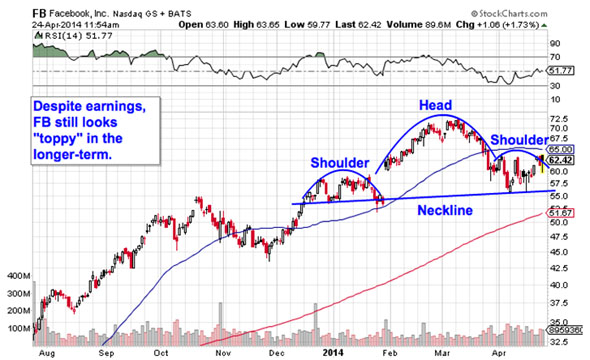

Facebook

Nearest Resistance: $65

Nearest Support: $55

Catalyst: Q1 Earnings

Social media giant Facebook (FB) is seeing big volume this afternoon after posting its first quarter earnings numbers after the bell yesterday. Facebook reported earnings of 34 cents per share, a number that came in above consensus. Importantly, mobile ads made up almost 60% of total ad revenues, doubling over the same quarter last year. But if Facebook's 1.1% move on big volume seems less than impressive today, a look at the chart is in order.

Facebook has been forming a bearish head and shoulders setup for the last four months, a price pattern that indicates exhaustion among buyers. We're seeing that exhaustion in FB's lack of follow-through today. If shares can't move above the 50-day moving average, the $55 neckline level is the price to watch. If Facebook slips below $55, look out below.

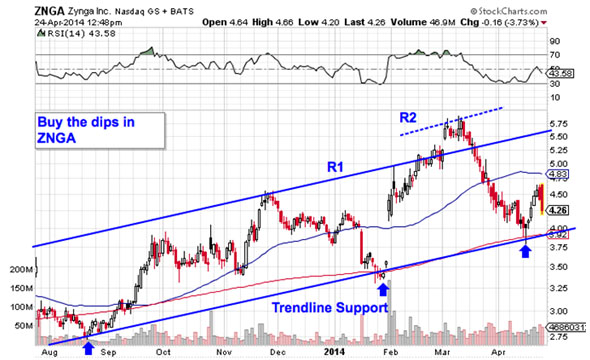

Zynga

Nearest Resistance: $5.50

Nearest Support: $4

Catalyst: Q1 Earnings

Facebook's "little buddy," Zynga (ZNGA), is down 3.6% on big volume this afternoon, shoved lower by its own earnings call. Zynga lost 1 cent per share for the quarter, a number that met Wall Street's expectations. But the firm didn't impress with forward guidance, which it expects to come in at a narrow profit for the full year. Zynga founder Mark Pincus also announced that he would no longer be involved in day-to-day operations at the firm.

The earnings reaction isn't exactly inspiring today, but frankly, the chart could look a lot worse. ZNGA has been in a textbook uptrend since last fall, and that makes a pullback a good opportunity to get in with a buy. Support at $4 is an optimal entry point.

Apple

Nearest Resistance: $570

Nearest Support: $540

Catalyst: Q2 Earnings

Apple (AAPL) is another name that's getting big attention following earnings. For its fiscal second quarter, Apple earned $11.62 per share, a number that beat the average analyst estimate by $1.44. Strong iPhone sales made up for weakness in iPads for the quarter, helping the firm deliver more than $13.5 billion in operating cash flow last quarter in the process. Apple also announced an aggressive plan to return capital to shareholders to the tune of $130 billion by the end of next year.

Technically speaking, AAPL's 8% gap up today is an important breakout. Shares had been basing in an inverse head and shoulders setup for the last few months, but today's move has Apple testing 52-week highs again. Once AAPL can catch a bid above $570, shares should have considerable room to move higher.

Qualcomm

Nearest Resistance: $84

Nearest Support: $77

Catalyst: Q2 Earnings

Bad guidance is to blame for Qualcomm's (QCOM) 3.4% stumble on big volume this afternoon. The mobile chipmaker reported profits of $1.31 per share, beating Wall Street's $1.22 best guess. But QCOM's guidance came in on the low side of analysts' estimates, and that's a big part of today's downside move.

Qualcomm has been a "buy the dips" name since last fall, when it started bouncing higher in an uptrending channel. So while today's stumble looks negative at first glance, it's giving QCOM buyers yet another dip to buy -- the last seven have been optimal buying opportunities. If you decide to go long here, I'd recommend putting a protective stop just below the 50-day moving average.

To see these stocks in action, check out the at Most-Active Stocks portfolio on Stockpickr.

-- Written by Jonas Elmerraji in Baltimore.

RELATED LINKS:

>>QE5 Is Coming -- Here's What It Means to Your Portfolio

>>5 Stocks With Big Insider Buying

>>3 Big-Volume Stocks to Trade for Breakouts

Follow Stockpickr on Twitter and become a fan on Facebook.

At the time of publication, author was long AAPL.

Jonas Elmerraji, CMT, is a senior market analyst at Agora Financial in Baltimore and a contributor to

TheStreet. Before that, he managed a portfolio of stocks for an investment advisory returned 15% in 2008. He has been featured in Forbes , Investor's Business Daily, and on CNBC.com. Jonas holds a degree in financial economics from UMBC and the Chartered Market Technician designation.Follow Jonas on Twitter @JonasElmerraji

Tuesday, March 10, 2015

Don’t Have Savings? Quit Making Excuses

I'm back, and I sound just like your mom: Save that damned emergency fund, already.

This week (Feb. 24-March 1) is America Saves Week. And not a moment too soon: As a nation, we're losing ground. An ASW survey shows that just 51 percent of us have a savings plan with specific goals; four years ago that number was 55 percent. (Still too low, IMHO.) Just 40 percent of us have budgets that allow for savings at all, compared with 46 percent in 2010.

The ASW report notes several reasons (stop me if these sound familiar): relatively high unemployment and underemployment rates, stagnant wages and the struggle to pay off homes. (Hint: In the past four years, the number of homeowners who expected to pay off mortgages before retirement dropped 10 percent.)

So yes, I know it can be hard to save. Boy, do I know. (More on that later.) This is especially true if you're living paycheck to paycheck or, worse, from unemployment check to unemployment check. But in most cases saving is possible.

I didn't say "easy" or "fun." I said possible. Take a look at "Stealth savings: Sneaky ways to fatten your account." Go ahead. I'll wait.

You'll notice I wrote that one as well. Saving is one of my personal drumbeats. I implore everyone I know (and plenty I don't know – thanks, WordPress!) to carve even a dollar a week out of their budgets and into emergency funds.

Preparing for the inevitable

Why? Because emergencies happen, dammit. If you think you're having trouble making ends meet now, wait until that bald-as-an-inner-tube tire finally blows out and you don't have a dime.

Then you might face some fairly lousy choices:

Putting the fix on a credit card. If you're living hand-to-mouth now, how long do you think it'll take to pay that off? Taking out a payday loan. Don't. Just don't! Not going to work because you can't get there. Good idea!Maybe you're lucky enough to have a relative or friend who will lend you money in case of an emergency. At least that way you won't have to pay interest. But the fact is, you now owe someone and have no clear plan how you'll pay it back.

If you'd saved that damned EF you could borrow it from yourself, and pay yourself back. Maybe even with interest.

Things may not always go your way

Understand: I am not berating those of you who really can't save anything due to desperate times. You know who you are.

And those of you who merely think you can't save? You may not know who you are. But I do.

You're the ones who gripe about being "broke" while eating chicken wings at a sports bar. The folks who spend a ton on concerts, sporting events, movies or other recreation without considering future needs. The men and women who treat shopping as an avocation, often dressing it up (so to speak) as "investing" in business wear.

People who eat lunch out every single day and/or refuse to learn to cook their own dinners. People who cook but who buy whatever looks good and include 12-packs of beer or soda with every grocery order. (Full disclosure: I drink Diet Coke. I also have an emergency fund.)

Women who get mani-pedis on a regular schedule. Men who insist on picking up the tab for every date. Families who sign up for satellite TVs and give their kids cell phones even though they can't pay their bills.

You get the picture. People who want what they want when they want it. People who think that they'll always have the world by the ass. People who think the books are balanced as long as they can keep the lights on, make minimum payments on their cards and look really FABulous for those feverish Saturday nights.

Wake up and smell reality

Have any of you thought about what will happen if you suddenly need a chunk of cash and don't have it? Nope, I didn't think so.

Hope the memory of those shiny nails or your team's surprise win can tide you over during your scramble to meet the unexpected obligation. Had you skipped even a few of those extras each month you'd have the money sitting in the bank, all liquid and useful.

All the interest you're paying on those cards? That's money you can no longer put to work for more useful things, such as an eventual home of your own or planning for retirement.

And heaven forbid that you lose your job. According to a 2013 study from Bankrate.com, here's how we stack up in terms of preparedness:

Fewer than one in four have at least a six-month EF Half of us have less than a three-month EF The rest have no savings at allIf you're already living pretty close to the bone, that Saturday matinee or the weekly six-pack of craft beer might be your only luxury. I get it. It's so nice to have even a small indulgence now and then.

But you know what else is nice? Solvency. Peace of mind. A good night's sleep. Hard to have those things when you're busy robbing Peter to pay Paul (while dodging your ol' friend Overdue Bill).

Put another way: A friend of mine never answers her phone before 9 p.m., because it might be a collections agency. Some fun, huh?

Why, yes, I do have the moral high ground!

Years ago I was a single mom in a big city, employed on a "permanent part-time" basis (30 to 35 hours per week – that way they didn't have to pay full benefits). I didn't receive child support, food stamps or rent assistance. We got by, barely, but without much wiggle room.

Yet I automated a weekly withdrawal through our employee credit union and then learned to live on what was left. It was a grown-up kind of thing. You should try it.

Some of my survival tactics were extreme, especially the hand-washing of all our laundry (even the cloth diapers). But most of the ways I trimmed expenses remain timeless:

Picking up extra work. I babysat, proofread for a friend's alternative newspaper, stuffed envelopes for another friend's small business and, when times were really tight, sold my blood for $6 a pint (and the cheap bastards at the for-profit blood center didn't even give you as much as a saltine afterward – leave your liquid and hit the road, willya?).

Cooking at home: We ate a lot of homemade bean soup, spaghetti, chili and eggs, plus the cheapest fruits and veg from Philly's numerous produce stands. Once a week or so I'd buy a single chicken leg quarter from a nearby market. The guy behind the counter used to kid me: "Come on, live it up – buy two!" He would never know how I hoarded change just to be able to buy one. (It was for the baby, incidentally. However, I did use a piece of bread to wipe the fat from the baking pan for myself.)

Using coupons: Although this was back in the late 1970s, both a supermarket and a regional drugstore doubled coupons, which meant I paid little or nothing for toiletries and certain foodstuffs. This was also the heyday of manufacturer refunds; I actually subscribed to a refund newsletter because it paid for itself almost immediately, and those $1 and $2 checks were a huge help.

Eschewing brand loyalty: Generic apple juice (which I diluted with water) for the baby. Store-brand pasta because it was 20 percent cheaper than Ronzoni. Whatever toothpaste matched my coupon.

Selling stuff. In my case that was blood (see above) and books – I worked at a newspaper and the book editor, who felt sorry for me, loaded me up with paperbacks. Every so often I'd take them to a used-books emporium that paid me a dime apiece.

Knowing that I had savings was a great comfort because I felt that I was getting ahead (however slowly) despite whatever life threw at me. My small EF was a godsend when my baby needed an expensive (to me) medicine, or when the price of even a thrift-shop toddler snowsuit torpedoed my weekly budget.

I hope you never have to hand-wash diapers or sell your blood. But I do hope you'll make it your business to automate some savings for yourself. If there's one thing that's certain in life, it's that life is utterly uncertain.

So get real, get smart and save that damned EF. The future you will be glad you did. Your credit card company will probably mope, though.

This original article: Don't have savings? Quit making excuses appeared on GetRichSlowly.org

1 stock to boost your financial health

Opportunities to get wealthy from a single investment don't come around often, but they do exist, and our chief technology officer believes he's found one. In this free report, Jeremy Phillips shares the single company that he believes could transform not only your portfolio, but your entire life. To learn the identity of this stock for free and see why Jeremy is putting more than $100,000 of his own money into it, all you have to do is click here now.

Additional savings articles can be found on GetRichSlowly.org

How and why to start an emergency fund

The opportunity fund: How to be prepared for lucky breaks

Is it possible you don't need an emergency fund?

Sunday, March 8, 2015

China expands OTC stock market nationwide

SHANGHAI--China is opening up its over-the-counter stock market to numerous small businesses, offering a fresh funding channel to the firms, which are seen as vital to employment and economic growth.

The State Council, or cabinet, said in a statement Saturday that the primary over-the-counter market is being opened to "qualified" companies around the country.

Until now, only unlisted firms in high-tech zones in four cities have been eligible for such fund-raising activities through the national OTC market, called the National Equities Exchange and Quotations System, where more than 300 firms trade.

The statement, which was dated Friday and appeared to be effective immediately, said the market is aimed at serving smaller, innovative and start-up businesses.

Despite their major contribution to creating jobs and economic growth, small businesses in China have considerable difficulty raising money from banks or investors in the capital markets. They are often cut off from loans from the state-dominated banking system, which tends to favor state-run companies, while the country's stock listing and bond issuance rules often block their access to traditional capital markets.

Beijing stopped approving any initial public offerings in October of last year, in a move that analysts say was aimed at shoring up market confidence by ending a share glut.

More recently, however, regulators have signaled that they are about to resume IPOs for the main stock exchanges and make share offers easier by removing some regulatory hurdles.

The OTC market was created to help unlisted firms that do not meet listing requirements by letting them raise funds through share sales.

The OTC market is based on a trial program set up in Beijing in 2006. It was initially limited to companies registered in a special development zone for high-tech companies and was expanded to firms in high-tech zones in Shanghai, Wuhan and Tianjin in 2012.

The State Council statement said that any joint-stock companies that meet requirements will be able to apply for the right to transfer shares, obtain equity or debt financing or reorganize their assets through the OTC market. Unlike on the main exchanges, which have stricter profit requirements, companies that are not profitable will be eligible for trading on the OTC market.

Companies on the OTC market can also apply for a listing on the stock markets once they meet listing requirements.

The announcement followed a November meeting of top Communist Party officials in which a blueprint for reform was set out for the next decade. That program called for market forces to play a "decisive" role in the economy.

China's leaders said they wanted to "refine the multi-level capital market system." Market participants viewed the wording as a sign of Beijing's support for the national OTC market.

As part of efforts to build an effective capital market system for domestic companies, China has gradually expanded its effort to offer access to smaller companies. Following the launch of the stock markets in 1990, it set up a board for small- and medium-sized enterprises in 2004 and another for start-up companies in 2009, where around 1,000 firms have been listed. These are still a tiny fraction of the nation's smaller businesses.

Subscribe to WSJ: http://online.wsj.com?mod=djnwires