The Walt Disney Company (NYSE:DIS) needs to look over its shoulder. For that matter, Lions Gate Entertainment Corp. (NYSE:LGF) may want to do the same. There's a little company called Independent Film Development Corporation (OTCMKTS:IFLM) that could become a big threat to both of those major players soon, now that a nagging monkey is officially off its back.

What could a relatively unknown independent film and television outfit like Independent Film Development Corporation do that was a real threat to a name like The Walt Disney Company, or even the lesser-established Lions Gate Entertainment Corp.? Answer: You might be surprised. Remember, when Walt Disney got the ball rolling back in the late 30's, life didn't get easy - nor did the money start to flow in earnest - until the 50's. Prior to that, Disney was largely just another company being held together by sheer willpower. As for Lions Gate Entertainment, prior to huge success as the brains and marketing firepower behind the Twilight movie franchise and a stroke of luck with television's MadMen, Lions Gate wasn't exactly a name that stopped people in their tracks either. Point being, never say never. One good show or movie could literally change everything, the way Cinderella did for The Walt Disney Company in 1950.

But is Independent Film Development Corporation - aka IndyFilmCorp - going to attack on the television and film front, or the theme park front (where none have yet to dethrone Disney)? Despite the moniker, it's the theme park industry that makes IFLM such an interesting stock right now.

Just for the record, Independent Film Development Corporation really is an independent film company. Though it doesn't have the library that a name like Lions Gate Entertainment has - at least not yet - it's got a decent library, and has proven its chops in the arena. It's the producer of the Autograph celebrity biography series, and it owns the rights to the perennially popular Three Stooges shorts, just to drop a few names. It's not film and television that's apt to put IFLM on the map, however. No, the reason The Walt Disney Company needs to be particularly worried is because IndyFilmCorp is planning a new kind of theme park that could make DisneyLand and DisneyWorld look like a schoolyard playground.

Times are changing. So are tastes. Technology has a lot to do with that, whether you're talking about the realism seen on the big and small screen, or the telecommunications technologies that keep all of us connected to, well, everything, all the time. Most consumers have seen, heard, and done it all, if not in real life, then at least digitally. That's what makes it tough for Disney's theme parks to "wow' guests year in and year out. Independent Film Development Corporation has a plan, however, to actually get the adrenaline pumping for theme park guests again. It's going to immerse visitors in an experience that combines special effects with state-of-the-art film technologies that don't just show an amusement park patron something interesting, but lets them live it.... perhaps wondering if what they're seeing may well be real, and not some stage-show.

In other words, IndyFilmCorp is planning to build a theme park that crosses the "cute" line that Disney wouldn't (and won't) cross to enter the place in people's minds where "holy @#$%" will be a common response. Some of the planned attractions at the park being planned for the 500-acre property in the Catskills, New York, are a water flume ride that feels like a journey through the River Styx (with a narrow, splash-filled escape from Hades), a haunted house with ghosts rendered as holograms rather than just a light shining through cardboard cutouts, and instead of lovable cartoon characters walking around the park passing out hugs, guests at the IndyFilmCorp amusement park will catch a glimpse of Bigfoot lurking around the park's tree-laden areas.

Intense? Yes, but that's the point. Consumers want more intensity, and they want help suspending their beliefs of what they know to be real... something most theme parks like Disney can't quite do, as they lack the visual, movie-caliber special effects that Independent Film Development Corporation plans to make a part of the park.

So what, pray tell, is such a big deal all of a sudden? Per this morning's press release, IFLM was victorious in a key court case against a former partner. The end result of that courtroom victory is the cancellation of what would have been a disadvantageous funding deal, plus an award of a little more than $200,000 in cash. The real benefit of the court case, however, is that the company can now focus on the development of the first of what could be many such theme parks rather than worry about arguing things out in a court room. From here, investors and observers can probably expect to see more frequent progress updates on the theme park front. That's always helpful for the underlying stock.

For more information on the theme park concept, here's the company's letter to shareholders unveiling the idea.

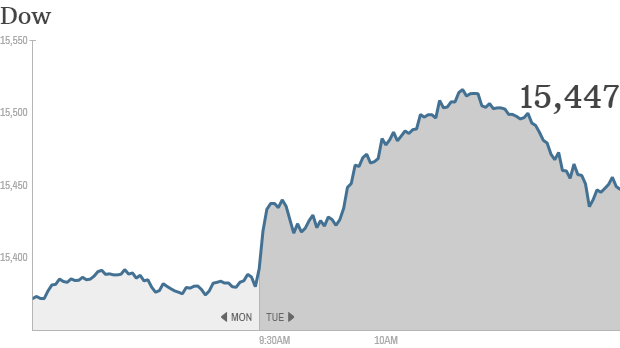

As stocks have continued to rise over the past year, so too have price/earnings ratios. Back in mid-November of last year, for example, the S&P 500 was trading for just under 16 times trailing 12-month as-reported earnings. Today, that figure is up above 18.

As stocks have continued to rise over the past year, so too have price/earnings ratios. Back in mid-November of last year, for example, the S&P 500 was trading for just under 16 times trailing 12-month as-reported earnings. Today, that figure is up above 18. Bloomberg News

Bloomberg News

General MotorsThe 2014 Chevrolet Silverado was a strong seller for GM, without the incentives that the model has needed in recent years. General Motors (GM) reported a third-quarter profit that beat estimates Thursday, thanks in part to strong U.S. sales of pickup trucks and sport utility vehicles. Excluding some one-time items, GM's profit rose to $0.97 a share. That's up a penny from a year ago, and $0.02 ahead of Wall Street's estimate. Some Wall Street analysts had expressed concern that GM's earnings would be hit hard by challenges in Russia and South America. But the damage was less serious than they had feared -- and GM's new trucks helped offset much of it. New Trucks and SUVs Have Improved GM's Profits at Home GM introduced all-new versions of its Chevy Silverado and GMC Sierra pickups last year, and new versions of its big SUVs earlier in 2014. Those products have posted good sales gains -- but more important, they're commanding much stronger markups than their predecessors. The old Silverado and Sierra sold well too -- but to get those strong sales, GM needed to offer high incentives. Incentives are the cash-back and cheap-financing deals that are so often featured in automakers' ads. Automakers use them as a way to adjust pricing in response to competition or market conditions. High incentives can boost sales quite a bit -- but at the expense of profits. GM's exact profit per sale is a closely guarded secret. But it's no secret that its new pickups and SUVs are much more profitable than the old ones. That means, for instance, that even though the Silverado's sales gains have been modest -- up 5.9 percent this year through September, versus a 22 percent gain for Fiat Chrysler's Ram -- GM's profits on the Silverado (and its other trucks) are almost certainly up quite a bit more. Earlier this year, those improved profits helped offset the steep costs of GM's massive recalls, keeping the company in the black. With recall-related costs mostly in the past, that money goes to GM's bottom line. The result: a $2.5 billion profit in North America, and an outstanding 9.5 percent operating profit margin. Working to Turn Around Losses in Europe and South America That profit margin is a big achievement for GM's new management, which has been focused on closing the profitability gap with rival Ford (F) in GM's home market. But GM's overseas divisions aren't nearly as profitable as North America. CEO Mary Barra has said that GM's goal is to consistently post a 9.5 percent profit margin for the whole company by early next decade. And GM still has a lot of work to do to get there. That work starts with Europe, where GM lost $387 million in the third quarter. GM has lost billions in Europe in recent years, but it's working on an aggressive turnaround plan that is expected to swing those losses to profits by 2016. The company has made progress. New models like the popular Opel Mokka SUV, a near-twin to the U.S.-market Buick Encore, have helped sales and profits. Meanwhile, a new management team has reduced costs, boosted sales, and helped integrate the Opel brand more closely with GM's global product plans. More recently, challenges in South America have weighed on GM and its key rivals. Those rivals include Ford, which warned last month that it would lose a billion dollars in South America in 2014 following big slowdowns in Brazil and some other Latin American nations. GM South America isn't doing quite that badly. But it did lose $32 million in the third quarter, down from a solid $284 million profit a year ago. GM Is Still Strong in China, and Working to Get Stronger Asia has been a bright spot for GM for several years now. Barra noted on Thursday that GM has a 15.2 percent share of China's market, the world's largest. That's second only to mighty Volkswagen (VLKAY) -- and GM is investing aggressively to ensure that its growth outpaces that of the overall market. It may sound ironic to Americans, but GM's Chinese unit was caught off guard by a boom in SUV sales that materialized over the past couple of years. Of course, GM sells plenty of SUVs and crossovers in the U.S. and other markets, but it didn't have many in China. That will change over the next year or two as GM sets up new manufacturing lines for several of those SUV models in China. Meanwhile, its existing products are still doing well. GM's Asian joint ventures made $490 million in the third quarter. Most of that was from China, and it was good enough to give GM a 9.6 percent operating profit margin in the world's largest auto market. How GM Will Put the Recalls in the Past Barra is clearly hoping to put GM's recall mess in the rearview mirror and get investors -- and customers -- focused on its much-improved cars and trucks, and its improving profit picture. That will take time. GM has recalled over 30 million vehicles this year, and many have yet to be fixed. There are still lawsuits pending, and GM may end up paying billions to settle potential criminal charges. Barra and her team can't really control how all of that unfolds. But the things they can control -- GM's business efforts and its products -- are steadily improving, and the company's long-term plans are still on track. Those improvements, in time, are how Barra and GM will make the recalls old news. More from John Rosevear

General MotorsThe 2014 Chevrolet Silverado was a strong seller for GM, without the incentives that the model has needed in recent years. General Motors (GM) reported a third-quarter profit that beat estimates Thursday, thanks in part to strong U.S. sales of pickup trucks and sport utility vehicles. Excluding some one-time items, GM's profit rose to $0.97 a share. That's up a penny from a year ago, and $0.02 ahead of Wall Street's estimate. Some Wall Street analysts had expressed concern that GM's earnings would be hit hard by challenges in Russia and South America. But the damage was less serious than they had feared -- and GM's new trucks helped offset much of it. New Trucks and SUVs Have Improved GM's Profits at Home GM introduced all-new versions of its Chevy Silverado and GMC Sierra pickups last year, and new versions of its big SUVs earlier in 2014. Those products have posted good sales gains -- but more important, they're commanding much stronger markups than their predecessors. The old Silverado and Sierra sold well too -- but to get those strong sales, GM needed to offer high incentives. Incentives are the cash-back and cheap-financing deals that are so often featured in automakers' ads. Automakers use them as a way to adjust pricing in response to competition or market conditions. High incentives can boost sales quite a bit -- but at the expense of profits. GM's exact profit per sale is a closely guarded secret. But it's no secret that its new pickups and SUVs are much more profitable than the old ones. That means, for instance, that even though the Silverado's sales gains have been modest -- up 5.9 percent this year through September, versus a 22 percent gain for Fiat Chrysler's Ram -- GM's profits on the Silverado (and its other trucks) are almost certainly up quite a bit more. Earlier this year, those improved profits helped offset the steep costs of GM's massive recalls, keeping the company in the black. With recall-related costs mostly in the past, that money goes to GM's bottom line. The result: a $2.5 billion profit in North America, and an outstanding 9.5 percent operating profit margin. Working to Turn Around Losses in Europe and South America That profit margin is a big achievement for GM's new management, which has been focused on closing the profitability gap with rival Ford (F) in GM's home market. But GM's overseas divisions aren't nearly as profitable as North America. CEO Mary Barra has said that GM's goal is to consistently post a 9.5 percent profit margin for the whole company by early next decade. And GM still has a lot of work to do to get there. That work starts with Europe, where GM lost $387 million in the third quarter. GM has lost billions in Europe in recent years, but it's working on an aggressive turnaround plan that is expected to swing those losses to profits by 2016. The company has made progress. New models like the popular Opel Mokka SUV, a near-twin to the U.S.-market Buick Encore, have helped sales and profits. Meanwhile, a new management team has reduced costs, boosted sales, and helped integrate the Opel brand more closely with GM's global product plans. More recently, challenges in South America have weighed on GM and its key rivals. Those rivals include Ford, which warned last month that it would lose a billion dollars in South America in 2014 following big slowdowns in Brazil and some other Latin American nations. GM South America isn't doing quite that badly. But it did lose $32 million in the third quarter, down from a solid $284 million profit a year ago. GM Is Still Strong in China, and Working to Get Stronger Asia has been a bright spot for GM for several years now. Barra noted on Thursday that GM has a 15.2 percent share of China's market, the world's largest. That's second only to mighty Volkswagen (VLKAY) -- and GM is investing aggressively to ensure that its growth outpaces that of the overall market. It may sound ironic to Americans, but GM's Chinese unit was caught off guard by a boom in SUV sales that materialized over the past couple of years. Of course, GM sells plenty of SUVs and crossovers in the U.S. and other markets, but it didn't have many in China. That will change over the next year or two as GM sets up new manufacturing lines for several of those SUV models in China. Meanwhile, its existing products are still doing well. GM's Asian joint ventures made $490 million in the third quarter. Most of that was from China, and it was good enough to give GM a 9.6 percent operating profit margin in the world's largest auto market. How GM Will Put the Recalls in the Past Barra is clearly hoping to put GM's recall mess in the rearview mirror and get investors -- and customers -- focused on its much-improved cars and trucks, and its improving profit picture. That will take time. GM has recalled over 30 million vehicles this year, and many have yet to be fixed. There are still lawsuits pending, and GM may end up paying billions to settle potential criminal charges. Barra and her team can't really control how all of that unfolds. But the things they can control -- GM's business efforts and its products -- are steadily improving, and the company's long-term plans are still on track. Those improvements, in time, are how Barra and GM will make the recalls old news. More from John Rosevear Related BZSUM Ascena Retail Drops On Downbeat Earnings; CF Industries Shares Gain Markets Mixed; Carnival Profit Tops Street View

Related BZSUM Ascena Retail Drops On Downbeat Earnings; CF Industries Shares Gain Markets Mixed; Carnival Profit Tops Street View  Spencer Platt/Getty ImagesTrump Entertainment Resortsplans to close the Trump Plaza Hotel and Casino on Sept. 16. ATLANTIC CITY, N.J. -- Trump Entertainment Resorts filed for bankruptcy Tuesday and threatened to shut down the Taj Mahal Casino Resort, which would make it the fifth Atlantic City casino to close this year. The company owns Trump Plaza, which is closing in a week, and the Taj Mahal, which has been experiencing cash-flow problems and had been trying to stave off a default with its lenders. The company said the Taj Mahal could close Nov. 13 if it doesn't win salary concessions from union workers. It's the fourth such filing for the struggling casino company or its corporate predecessors. The company filed in U.S. Bankruptcy Court in Wilmington, Delaware, saying it has liabilities of between $100 million and $500 million, and assets of no more than $50,000. It missed its quarterly tax payment due last month, and says it doesn't have the cash to make an interest payment to lenders due at the end of the month. It also says both its Internet gambling partners have taken steps to end their contracts with Trump Entertainment. It said cost-cutting negotiations with the main casino workers' union have stalled, and that the company is preparing notices warning employees the Taj Mahal may close on Nov. 13. "Absent expense reductions, particularly concessions from their unions, the debtors expect that the Taj Mahal will close on or shortly after November 13, 2014 and that all operating units will be terminated between November 13, 2014 and November 27, 2014," the company wrote in its bankruptcy filing. If the company makes good on its threat to close the Taj Mahal, it would further rock an already shell-shocked casino market in what just a few years ago was the nation's second-largest gambling market after Nevada. Now, New Jersey has fallen behind Pennsylvania. Three other Atlantic City casinos have closed this year, as the industry struggles with competition in nearby states. Atlantic City began the year with 12 casinos, but could end it with seven if the Taj Mahal closes. So far this year, the Atlantic Club, Showboat and Revel have gone out of business, with Trump Plaza closing next Tuesday. The bankruptcy filing came a day after Gov. Chris Christie's administration told the state's casinos and horse tracks that they can legally offer sports betting -- a move that defies a federal ban on it and is sure to be challenged in court by the professional and amateur sports leagues which have fought it thus far. Trump Entertainment has struggled since the day it emerged from its last bankruptcy in 2010, having filed the year before. It came out of bankruptcy with $350 million in debt, and currently has more than $285 million in debt. As of the end of July, the company employed 2,800 people. The company has been trying to reduce expenses and debt, including selling its former Trump Marina casino for $38 million to Landry's, which now runs it as the Golden Nugget Atlantic City. It also sold the Steel Pier for $4.5 million; a warehouse for $1.9 million, and its former corporate offices in a converted firehouse for $3.1 million. That building now houses the Casino Reinvestment Development Authority. It has been trying for years to sell Trump Plaza. A deal to sell it to a California firm for $20 million last year fell through. The company also said it has been in negotiations with Local 54 of the Unite-HERE union on cost-cutting measures it says it needs to survive, but that the union has rejected them. Bob McDevitt, the union president, said that Trump Entertainment wanted union members to surrender their health insurance and pension plans, something he rejected. McDevitt said that even if the union agreed to those concessions, they would only total $11 million per year, which would hardly make a difference in the company's finances. The concessions would be on top of a separate $4 million round of union concessions the company won in 2011. Donald Trump owns a 9 percent stake in the firm, but neither controls it nor has any involvement in it. He is suing the company to remove his name from the properties, which he says have fallen into disrepair and do not meet agreed-upon standards of quality and luxury.

Spencer Platt/Getty ImagesTrump Entertainment Resortsplans to close the Trump Plaza Hotel and Casino on Sept. 16. ATLANTIC CITY, N.J. -- Trump Entertainment Resorts filed for bankruptcy Tuesday and threatened to shut down the Taj Mahal Casino Resort, which would make it the fifth Atlantic City casino to close this year. The company owns Trump Plaza, which is closing in a week, and the Taj Mahal, which has been experiencing cash-flow problems and had been trying to stave off a default with its lenders. The company said the Taj Mahal could close Nov. 13 if it doesn't win salary concessions from union workers. It's the fourth such filing for the struggling casino company or its corporate predecessors. The company filed in U.S. Bankruptcy Court in Wilmington, Delaware, saying it has liabilities of between $100 million and $500 million, and assets of no more than $50,000. It missed its quarterly tax payment due last month, and says it doesn't have the cash to make an interest payment to lenders due at the end of the month. It also says both its Internet gambling partners have taken steps to end their contracts with Trump Entertainment. It said cost-cutting negotiations with the main casino workers' union have stalled, and that the company is preparing notices warning employees the Taj Mahal may close on Nov. 13. "Absent expense reductions, particularly concessions from their unions, the debtors expect that the Taj Mahal will close on or shortly after November 13, 2014 and that all operating units will be terminated between November 13, 2014 and November 27, 2014," the company wrote in its bankruptcy filing. If the company makes good on its threat to close the Taj Mahal, it would further rock an already shell-shocked casino market in what just a few years ago was the nation's second-largest gambling market after Nevada. Now, New Jersey has fallen behind Pennsylvania. Three other Atlantic City casinos have closed this year, as the industry struggles with competition in nearby states. Atlantic City began the year with 12 casinos, but could end it with seven if the Taj Mahal closes. So far this year, the Atlantic Club, Showboat and Revel have gone out of business, with Trump Plaza closing next Tuesday. The bankruptcy filing came a day after Gov. Chris Christie's administration told the state's casinos and horse tracks that they can legally offer sports betting -- a move that defies a federal ban on it and is sure to be challenged in court by the professional and amateur sports leagues which have fought it thus far. Trump Entertainment has struggled since the day it emerged from its last bankruptcy in 2010, having filed the year before. It came out of bankruptcy with $350 million in debt, and currently has more than $285 million in debt. As of the end of July, the company employed 2,800 people. The company has been trying to reduce expenses and debt, including selling its former Trump Marina casino for $38 million to Landry's, which now runs it as the Golden Nugget Atlantic City. It also sold the Steel Pier for $4.5 million; a warehouse for $1.9 million, and its former corporate offices in a converted firehouse for $3.1 million. That building now houses the Casino Reinvestment Development Authority. It has been trying for years to sell Trump Plaza. A deal to sell it to a California firm for $20 million last year fell through. The company also said it has been in negotiations with Local 54 of the Unite-HERE union on cost-cutting measures it says it needs to survive, but that the union has rejected them. Bob McDevitt, the union president, said that Trump Entertainment wanted union members to surrender their health insurance and pension plans, something he rejected. McDevitt said that even if the union agreed to those concessions, they would only total $11 million per year, which would hardly make a difference in the company's finances. The concessions would be on top of a separate $4 million round of union concessions the company won in 2011. Donald Trump owns a 9 percent stake in the firm, but neither controls it nor has any involvement in it. He is suing the company to remove his name from the properties, which he says have fallen into disrepair and do not meet agreed-upon standards of quality and luxury. Kathy Willens/AP JPMorgan Chase reported a better-than-expected adjusted quarterly profit as the biggest U.S. bank kept a lid on costs and set aside less money to cover bad loans. The bank, which agreed last week to pay $2.6 billion to settle government and private claims over its handling of accounts of fraudster Bernie Madoff, said fourth-quarter net income fell 7.3 percent to $5.28 billion, or $1.30 a share. Adjusted for special items, the company earned $1.40 a share, beating the average analyst estimate of $1.35, according to Thomson Reuters I/B/E/S. The results took into account gains from the sale of Visa (V) shares and One Chase Manhattan Plaza and legal expenses related to the Madoff settlements. JPMorgan (JPM), which agreed to pay nearly $20 billion in 2013 to settle assorted legal claims, had estimated that settlement of the Madoff claims would subtract $850 million from fourth-quarter earnings. "It was in the best interests of our company and shareholders for us to accept responsibility, resolve these issues and move forward," Chairman and Chief Executive Officer Jamie Dimon said in a statement Tuesday. JPMorgan shares, which have been trading this month at their highest levels since 2000, were up 0.5 percent at $58 before the opening bell on the New York Stock Exchange. The stock rose 33 percent in 2013, in line with the 35 percent rise in the KBW Bank index and slightly ahead of the 29 percent gain in Standard & Poor's 500 stock index. Special items highlighted by the bank subtracted 10 cents a share from fourth-quarter earnings, compared with a two-cent boost in the same quarter of 2012. The special items included a benefit of 21 cents a share from the sale of Visa shares and 8 cents from the sale of One Chase Manhattan Plaza and an expense of 27 cents a share from legal bills, including the Madoff settlements. Three months ago, JPMorgan reported its first quarterly loss under Dimon after recording after-tax expenses of $7.2 billion to settle government and private investigations. The allegations involved, among other things, shoddy dealing in mortgage instruments before the financial crisis, derivatives trading in London and pricing in electric power markets, as well as failing to report suspicions of wrongdoing by Madoff. Investors have been looking for reassurance from the company that the worst of its legal expenses are behind it. Assets Shrink Noninterest expenses fell 3 percent to $15.55 billion during the quarter, while provisions for bad loans fell 84 percent to $104 million. JPMorgan said its assets shrank to $2.42 trillion at the end of December from $2.46 trillion three months before and $2.36 trillion a year earlier, but it remains the biggest U.S. bank by that measure. Equity underwriting revenue soared 65 percent to $436 million. But investment banking fees were pulled down by lower debt underwriting, where revenue declined 19 percent, and advisory fees, which fell 7 percent. Altogether, investment banking fees declined 3 percent. The bank's market share in equity underwriting rose to 8.3 percent in 2013, moving it to second place in the industry from fourth. Goldman Sachs Group (GS) led with 11.4 percent. Higher interest rates on home mortgage loans weighed on JPMorgan, like the rest of the banking industry. JPMorgan lost $274 million, pre-tax, making mortgage loans, compared with a profit of $789 million a year earlier as margins declined and as the company was unable to reduce expenses as quickly as lending volumes declined. The bank said it expected to lose money making mortgages again in the first quarter of this year. Reflecting a slowdown in loan refinancing, total U.S. home mortgage borrowing was down 50 percent at the end of December compared with a year earlier and down by a quarter from the end of September, according to the Mortgage Bankers Association. -.

Kathy Willens/AP JPMorgan Chase reported a better-than-expected adjusted quarterly profit as the biggest U.S. bank kept a lid on costs and set aside less money to cover bad loans. The bank, which agreed last week to pay $2.6 billion to settle government and private claims over its handling of accounts of fraudster Bernie Madoff, said fourth-quarter net income fell 7.3 percent to $5.28 billion, or $1.30 a share. Adjusted for special items, the company earned $1.40 a share, beating the average analyst estimate of $1.35, according to Thomson Reuters I/B/E/S. The results took into account gains from the sale of Visa (V) shares and One Chase Manhattan Plaza and legal expenses related to the Madoff settlements. JPMorgan (JPM), which agreed to pay nearly $20 billion in 2013 to settle assorted legal claims, had estimated that settlement of the Madoff claims would subtract $850 million from fourth-quarter earnings. "It was in the best interests of our company and shareholders for us to accept responsibility, resolve these issues and move forward," Chairman and Chief Executive Officer Jamie Dimon said in a statement Tuesday. JPMorgan shares, which have been trading this month at their highest levels since 2000, were up 0.5 percent at $58 before the opening bell on the New York Stock Exchange. The stock rose 33 percent in 2013, in line with the 35 percent rise in the KBW Bank index and slightly ahead of the 29 percent gain in Standard & Poor's 500 stock index. Special items highlighted by the bank subtracted 10 cents a share from fourth-quarter earnings, compared with a two-cent boost in the same quarter of 2012. The special items included a benefit of 21 cents a share from the sale of Visa shares and 8 cents from the sale of One Chase Manhattan Plaza and an expense of 27 cents a share from legal bills, including the Madoff settlements. Three months ago, JPMorgan reported its first quarterly loss under Dimon after recording after-tax expenses of $7.2 billion to settle government and private investigations. The allegations involved, among other things, shoddy dealing in mortgage instruments before the financial crisis, derivatives trading in London and pricing in electric power markets, as well as failing to report suspicions of wrongdoing by Madoff. Investors have been looking for reassurance from the company that the worst of its legal expenses are behind it. Assets Shrink Noninterest expenses fell 3 percent to $15.55 billion during the quarter, while provisions for bad loans fell 84 percent to $104 million. JPMorgan said its assets shrank to $2.42 trillion at the end of December from $2.46 trillion three months before and $2.36 trillion a year earlier, but it remains the biggest U.S. bank by that measure. Equity underwriting revenue soared 65 percent to $436 million. But investment banking fees were pulled down by lower debt underwriting, where revenue declined 19 percent, and advisory fees, which fell 7 percent. Altogether, investment banking fees declined 3 percent. The bank's market share in equity underwriting rose to 8.3 percent in 2013, moving it to second place in the industry from fourth. Goldman Sachs Group (GS) led with 11.4 percent. Higher interest rates on home mortgage loans weighed on JPMorgan, like the rest of the banking industry. JPMorgan lost $274 million, pre-tax, making mortgage loans, compared with a profit of $789 million a year earlier as margins declined and as the company was unable to reduce expenses as quickly as lending volumes declined. The bank said it expected to lose money making mortgages again in the first quarter of this year. Reflecting a slowdown in loan refinancing, total U.S. home mortgage borrowing was down 50 percent at the end of December compared with a year earlier and down by a quarter from the end of September, according to the Mortgage Bankers Association. -.

Whirlpool cleans up

Whirlpool cleans up