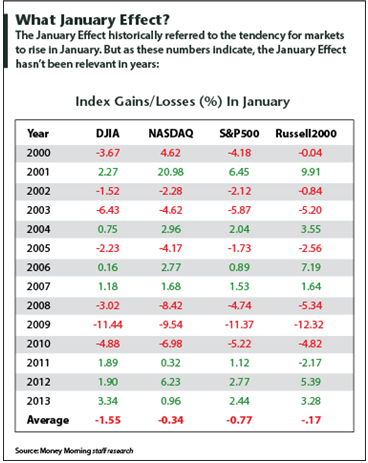

Investors love bullish trends like the January Effect - but does this rally even exist like it used to?

The January Effect is stocks' tendency to rise during the first month of the year. It's often paired with the bullish year-end "Santa Claus Rally" as a reason to expect a market bump from December to January.

The biggest market jump in December - January is normally seen on the last five trading days of the year and the first two of the New Year. When isolating that single week, the Standard & Poor's 500 Index has posted an average gain of 1.8% since 1929. Stocks have risen 79% of the time during that week over the past 83 years.

The historical reasons for the January Effect, however, have changed.

Here's what that means for stocks, and for the January 2014 stock market.

Where Does the January Effect Come From?The January Effect was first defined in 1942 by investment banker Sidney B. Wachtel. It has traditionally been attributed to year-end tax considerations.

As the explanation goes, investors typically sell some stocks they've taken a loss on at the end of the year, so they can deduct that loss from their income tax. Once the new year rolls around, they buy back the same stock, pushing up prices.

But that explanation may be a bit simplistic.

Click here for the full list of January open and closing prices for each index during the years listed.

In 1929, the IRS instituted the Wash Sale Rule, which prohibits investors from claiming a loss on a sale and then repurchasing the same stock or a nearly identical stock within 30 days. Investors may be reinvesting the money taken from the previous sale of securities, but that IRS provision seems to debunk the myth that the selling and rebuying for tax purposes is the main share-price driver.

Tax-sheltered retirement plans have also grown in popularity in recent years, ending the need for many investors to sell and rebuy stocks for tax purposes.

Another explanation for the January Effect is the "window dressing" that mutual funds perform toward the end of the year.

In order to make their portfolios appear as strong as possible, mutual funds will often dump losing stocks during December. They will then take the money they made from selling their positions, and reinvest it in the new year, creating a bump.The fact that investors will often invest their year-end bonuses in stocks can contribute to a rise in the markets as well.

Typically the biggest January Effect winners are small-cap stocks, which historically outperform midsized and large-cap stocks that month.

According to the Chicago Board Options Exchange (CBOE), the Russell 2000 Index - which measures small-cap performance - saw an average January gain of 2.5% from 1980 through 2006. That compares favorably to the January gains of the S&P 500 at 1.7%, the Dow Jones Industrial Average at 1.6%, and the Russell 1000 at 1.6% during the same time frame.

In the past eight years, however, the January Effect has been more tame than usual.

Since 2006, the Russell 2000 has posted an average gain of just 1.98% in the month of January (Not accounting for 2009, when all major markets posted significant losses).

However, those numbers still far outpace the broader markets in January. During the same timeframe (except 2009), the Dow is up an average of 0.45% in January and the S&P 500 has posted an average gain of just 0.02%.

The last eight years haven't produced the same January Effect that investors saw for decades, but that doesn't necessarily mean the trend of higher markets at the start of the year is dead.

Money Morning's Global Investing & Income Strategist Robert Hsu recently pointed to high liquidity in the U.S. equity markets, encouraging unemployment figures and strong gross domestic product growth as reasons why investors should expect gains at the end of 2013 and into 2014.

"Money flow into global stock markets remains strong, fueling major averages higher into the holiday season," Hsu wrote to his Permanent Wealth Investor subscribers earlier this month. "Last month, TrimTabs Investment Research reported that more than $40 billion flowed into U.S. equity markets, much of it from cash sitting on the sidelines."

Bottom line: Even if the original "January Effect" has faded, expect the markets to continue rallying through the end of 2013 and into 2014.

Get started now for your best profits ever in 2014: How to Profit When Billionaires Battle - A Plan

Related Articles:

The New York Times:January's Stock Temptation

No comments:

Post a Comment